The end of the year marks high hopes for Brazil in 2019

Brazil's economic recovery didn't really materialise in 2018 but the year ends with a post-election optimistic glow. Surging confidence indicators and continued monetary stimulus signal a faster recovery, but the sharp acceleration that some expect for 2019 remains conditional on Congress's approval of fiscal reforms

2018: A year of frustrated recovery expectations

Latest data has confirmed Brazil’s recovery has persisted but remains frustratingly slow. GDP is likely to grow at just 1.2% in 2018, which pales when compared to market expectations at the beginning of the year, which were close to 3%.

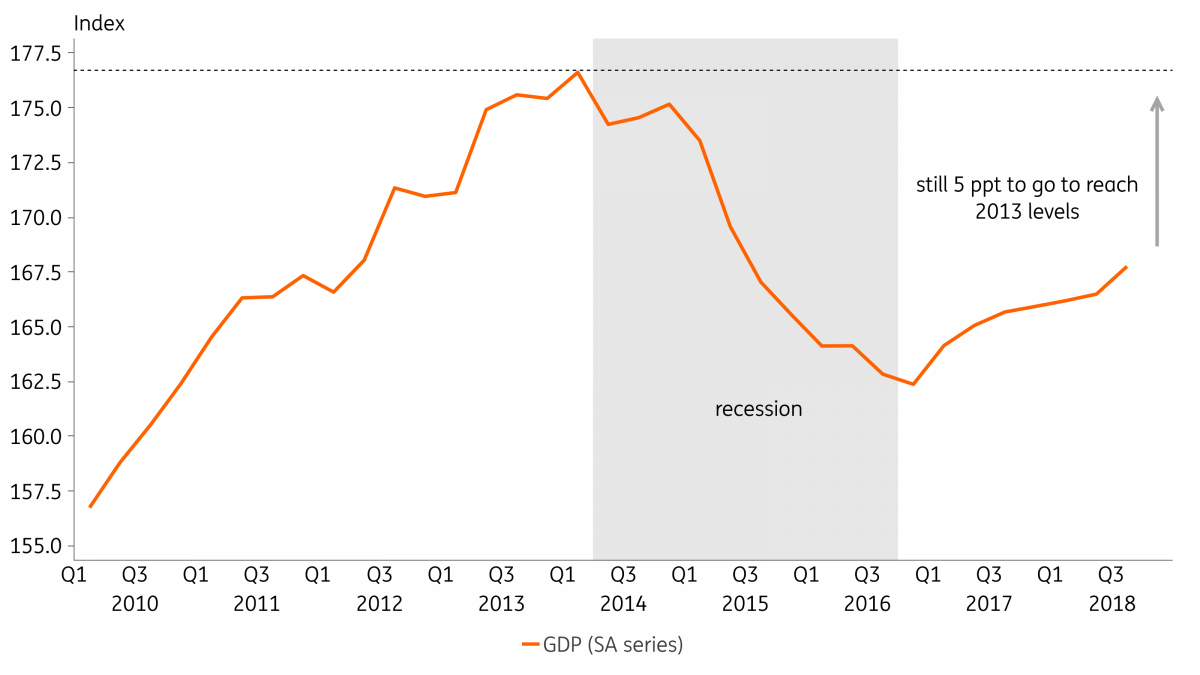

As the chart below shows, despite the expansion seen since the end of the recession, GDP is still five percentage points below the levels seen in 2013, in real terms.

Brazilian GDP

The case for growth

Growth expectations for 2019 have begun to climb, after remaining at 2.5% for a prolonged period and the post-election surge in some business and consumer confidence indicators suggests near-term growth prospects have indeed improved. However, even though we agree that election results have been positive for economic activity, as they improved the outlook for fiscal consolidation, the crucial question about the success of the fiscal effort remains.

Growth expectations for 2019 have begun to climb

Despite the recovery in confidence, fiscal uncertainties are likely to keep investors and consumers relatively cautious in 2019. In particular, a robust recovery depends on the appetite of banks and borrowers and the progress of capital investment, especially infrastructure, where the bottlenecks prevail. In our view, this may only happen after there is more clarity about the fiscal trajectory. The passage of the fiscal consolidation agenda, for example, the social security reform remains a pre-condition for a sustained recovery in long-term business sentiment.

The recently-elected Congress will be inaugurated on 1 February, but the new administration’s strategy vis-à-vis the social security reform is still unclear. We still don’t know if crucial votes will happen immediately, (i.e. February/March) in case Congress just resumes the debate of the reform introduced by President Temer, or later in the year, likely in 3Q, if a new draft reform is submitted to Congress.

In our base-case scenario, reform approval is more likely during 3Q, which would be more consistent with GDP growth close to 2.5% next year. However, an early approval (by the end of 1Q) would add material upside to our forecast, possibly towards 3-3.5%. Alternatively, failure to approve the reform in 2019 would likely trigger major instability in local markets and could crush hopes of a recovery.

Monetary policy takes a back-seat

The Brazilian central bank meets this week and, once again, it should keep the policy rate on hold at 6.5%. More importantly, the forward guidance should shift from cautiously hawkish to firmly neutral.

We expect Brazil's central bank's forward guidance to shift

We expect the guidance to reinforce the data-dependent nature of future policy decisions and the greater policy flexibility required in light of heightened (domestic and external) uncertainties. But policymakers should also indicate the balance of risks for inflation have become more balanced and is no longer “asymmetric”, skewed to the upside.

This shift would be consistent with the lower-than-expected inflation seen since the Bank’s last meeting. Over the past month, this has been helped by lower electricity/fuel prices and consensus expectations for 2018 have dropped by 70bp, to 3.7% now, as seen in the chart below. This is in line with our forecast of 3.8% and compares with the 4.5% target for the year.

For 2019, our initial forecast is 3.7%, lower than the market consensus of 4.1%. The bank’s own inflation forecasts should also fall, especially for short-term horizons. Those forecasts should remain in line with the 2019-20 targets (4.25% and 4.0% respectively), even in the reference scenario, in which the policy rate remains unchanged at 6.5% in the policy-relevant horizon.

Brazil inflation expectations

FX expectations amid social security reform jitters

In our view, as long as social security reforms remain on track for approval in 2019, the Brazilian Real should remain relatively well-behaved, and the central bank should keep the policy rate unchanged. Despite the rally in local bonds seen since October, the local curve still incorporates 125bp rate hikes next year, along with 200bp in 2020. If the social security reform fails to advance in Congress in a timely fashion, (i.e. still no approval by the end of 3Q), local assets are bound to suffer, with USD/BRL likely to rise above 4.0, worsening inflation expectations and triggering a hawkish monetary policy shift, with the central bank possibly launching a gradual rate-hiking cycle.

The Brazilian real should remain relatively well-behaved

Alternatively, if the reform gets approved, USD/BRL is likely to consolidate in the 3.7-3.6 range, after initially overshooting below 3.5. In this scenario, the market might expect the central bank has room to re-launch the monetary easing cycle. In our view, rate cuts could be considered, at the end of 2019/early-2020, depending on the depth of the fiscal adjustment set in motion in 2019.

A dovish monetary policy stance would also be consistent with Brazil’s ample spare capacity, high unemployment, fully-anchored inflation expectations, and the structural changes taking place in the local credit market, with a reduced presence of state-owned banks. Ultimately, a lasting fiscal policy adjustment could pave the way for monetary policy to stay expansionary for at least a few years, without risking turning the policy mix excessively expansionary.

| 6.5% |

SELIC policy rateCentral bank to keep rate unchanged |

A suspenseful 2019: Will the fiscal reforms finally get approved?

Politically, the transition period has been less fruitful than initially thought. Expectations that Congress would approve important legislation before the end of the year have, so far, not materialised. None of the legislative initiatives initially considered, such as the transfer of oil exploration rights, central bank independence or the social security reform proposed by President Temer, advanced much.

Members of Congress have promoted initiatives that clash directly with president-elect Jair Bolsonaro’s pro-market agenda. This includes a bill to increase political interference in regulatory agencies, and that eases fiscal constraints for municipalities, along with other measures calling for tax forgiveness. Ineffective political coordination by the new administration, which takes office on 1 January, helps explain the disappointing results. This may reflect, among other things, a combination of unpreparedness and the tiny size of Bolsonaro’s party (PSL) in the current Congress. But it also could reflect bigger problems, such as a deficit of savvy political negotiators in his team and the challenges he will face in his goal to change the way the executive negotiates with Congress.

We expect investors to remain narrowly focused on assessing Bolsonaro’s ability to approve his legislative agenda

On a positive note, the senior-level cabinet appointments announced in recent weeks have been very well-received. Particularly encouraging has been the cohesive vision suggested by the economic team, helmed by Paulo Guedes as Economy Minister. This includes new heads for the central bank (Roberto Campos Neto), state-owned banks including BNDES, Caixa and Banco do Brasil and Petrobras. The reappointment of Mansueto de Almeida as head of the National Treasury is also a favourable development. The newly created roles of a Secretary for Privatization and a Secretary for Social Security are noteworthy new initiatives, highlighting the importance of the two areas for the incoming administration.

Overall, we expect investors to remain narrowly focused on assessing Bolsonaro’s ability to approve his legislative agenda. Some of the near-term catalysts that could alter that assessment include political negotiations for the election of the presidencies of the Lower House and the Senate, along with the announcement of the new legislative agenda, especially whether Bolsonaro will support the approval of the social security reform already under debate in Congress.

In particular, we suspect local assets would react well to the re-election of Rodrigo Maia to lead the Lower House, with Bolsonaro’s support, and to a political agreement to finish the vote on the social security reform proposed by President Temer.

"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).