Bank Outlook 2023: Taxonomy Disclosures – what’s next for banks?

With the further implementation of the European Taxonomy and complementary directives, banks are facing new challenges. Besides IT and human capital developments, the main issue lies in obtaining sufficient data to comply with the new disclosure requirements

Current Taxonomy disclosures

A fundamental part of the action against the climate crisis is the definition and classification of sustainable activities. The European Taxonomy classification system aims at listing environmentally sustainable activities to enhance the transparency and comparability of the ESG performance metrics. To do so, it uses six environmental objectives:

- climate change mitigation

- climate change adaptation

- sustainable use of water and marine resources

- transition to a circular economy

- pollution prevention and control and finally

- protection and restoration of biodiversity and ecosystems.

Right now, only the two first objectives are fully covered.

The Taxonomy Delegated Act partially came into force in January 2022 with the requirement for non-financial and financial institutions to disclose their taxonomy-eligible assets as part of their disclosures under the Non-Financial Reporting Directive (NFRD).

In this first step, European banks have to disclose their share of assets eligible under the EU Taxonomy (EUT) regulation. Adopted in 2014, the Non-Financial Reporting Directive (NFRD) raises the transparency of the social and environmental information provided by companies in all sectors. Under the NFRD, all large listed companies, banks and insurance firms with more than 500 employees are required to report on the policies they implement regarding a broad range of criteria such as social responsibility, respect for human rights, anti-corruption and bribery, as well as diversity on company boards. Currently, when looking at the national transposition of the directive, around 11,000 of the biggest EU companies are required to disclose non-financial information under the NFRD and can therefore be considered taxonomy-eligible. However, this number is expected to significantly increase with the enforcement of another directive, namely the Corporate Sustainability Reporting Directive (CSRD).

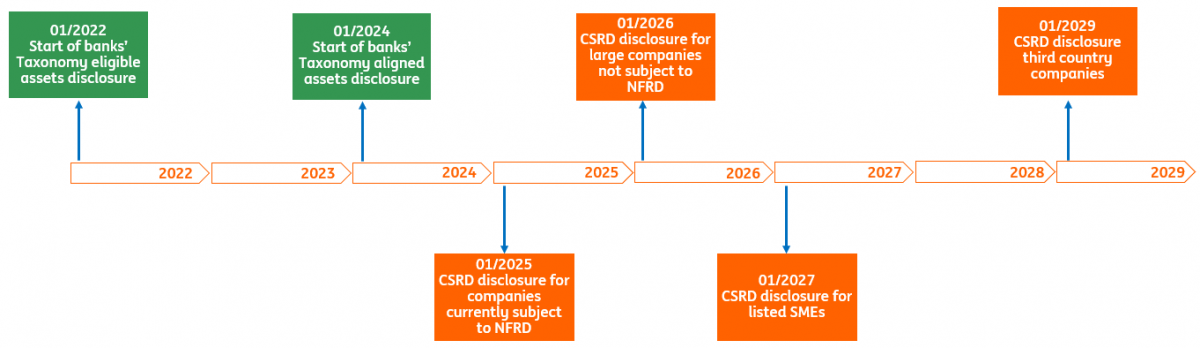

In 2024, the CSRD will come into force beside the NFRD. It will implement a common reporting framework for companies. This new directive will also gradually increase in scope to incorporate more companies than the NFRD. The changes will unfold in four steps as you can see in the chart below: firstly by disclosing taxonomy-eligible and aligned assets for companies under the NFRD, then by extending the requirement to all large companies not subject yet to the NFRD (i.e., unlisted large companies). The third step will require disclosure for listed SMEs and in the fourth step, companies with a net turnover of 150 million euros and with at least one subsidiary in the EU will also be required to disclose under the CSRD. Consequently, the scope of the Taxonomy will also gradually widen.

CSRD implementation timeline

As you can see, this year’s disclosure is only the first step of the EU taxonomy implementation process. In 2022 and 2023, banks are only required to disclose the share of eligible activities for the previous financial year and fine-tune their disclosure; but from January 2024, they will have to tackle the second step of the regulation by disclosing the share of taxonomy-aligned activities they hold.

The Green Asset Ratio in a nutshell

The European Commission requires credit institutions to publish several Key Performance Indicators (KPIs) giving insights into the extent to which their operations are environmentally sustainable, the most important one being the Green Asset Ratio (GAR). The GAR measures the share of the credit institution’s taxonomy-aligned balance sheet exposures over the total covered exposures. This indicator enables a quick and comparable overview of the credit institution’s alignment with the taxonomy. The GAR is calculated as follows:

The Green Asset Ratio (GAR)

Taxonomy-aligned exposures for loans & advances, debt securities and equity holdings / Total covered assets

The following on-balance sheet exposures are therefore considered as eligible:

- Non-financial corporates subject to NFRD disclosure obligations

- Financial corporates subject to NFRD disclosure obligations

- Retail exposures

- Loans and advances financing public housing

- Repossessed real estate collateral

Taxonomy-eligible: Activities identified in the Climate Delegated Act and (yet to be established) Environmental Delegated Act as eligible for the purpose of financing the EU Taxonomy's six environmental objectives.

Taxonomy-aligned: Taxonomy-eligible activities that fully comply with the EU Taxonomy’s technical screening criteria for substantial contribution, 'they do no significant harm' criteria and with the minimum safeguards.

Exposures to central governments, central banks and supranational issuers are excluded from the numerator and denominator of the GAR calculation. Exposure to undertakings not (yet) obliged to disclose non-financial information under the NFRD (or CSRD) will be excluded from the numerator of the GAR.

Overview of the 2021 taxonomy disclosures

This year’s first reporting wave didn’t include a common reporting framework, only the obligation to disclose the share of taxonomy-eligible assets in banks’ portfolios. Despite an overall similarity in the disclosure, discrepancies can be highlighted mainly in the calculation of the share of taxonomy-eligible assets. As most banks reported over the total assets, a few others reported over total covered assets. Furthermore, some credit institutions detailed their results by indicating sub-categories shares or the monetary amount on top of the requested share of assets.

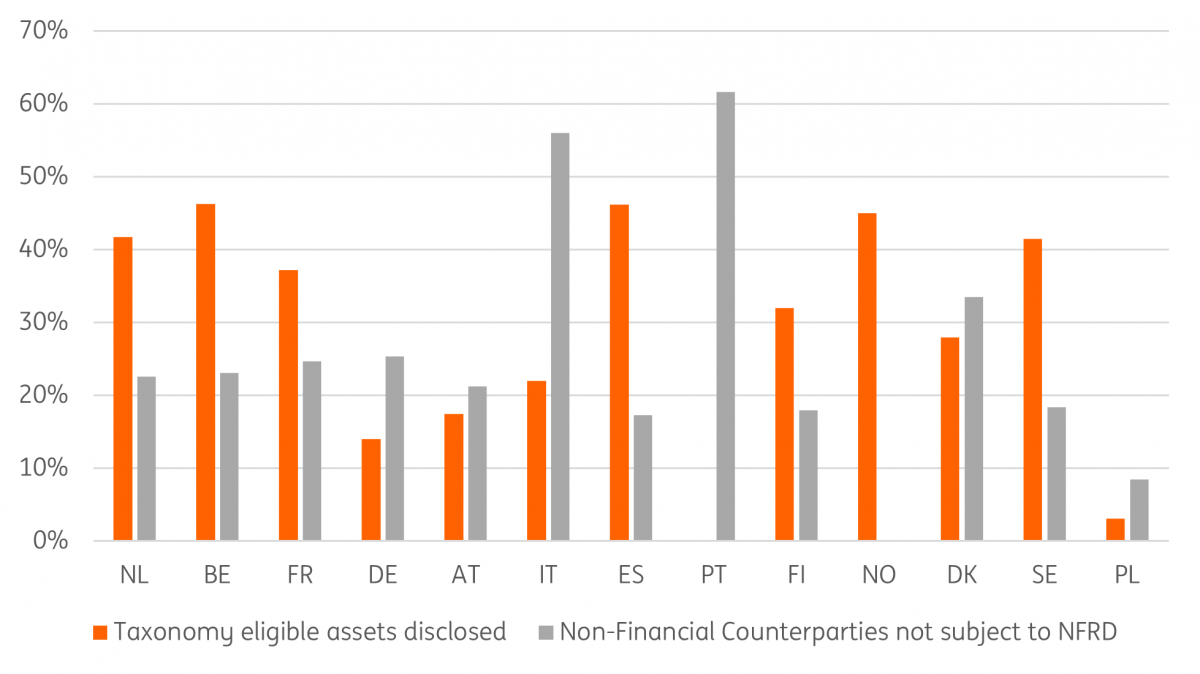

The data gathered from the first disclosures of the major European banks show results variations between financial institutions nationally but also internationally. The table below gives an overview of the average rate of taxonomy-eligible assets disclosed by the major European banks for FY2021 (averaged by country). The highest taxonomy-eligible assets rates are disclosed by both Belgian and Spanish credit institutions (with 46%) followed closely by Norwegian ones (45%).

Banks' 2021 taxonomy disclosures averaged by country*

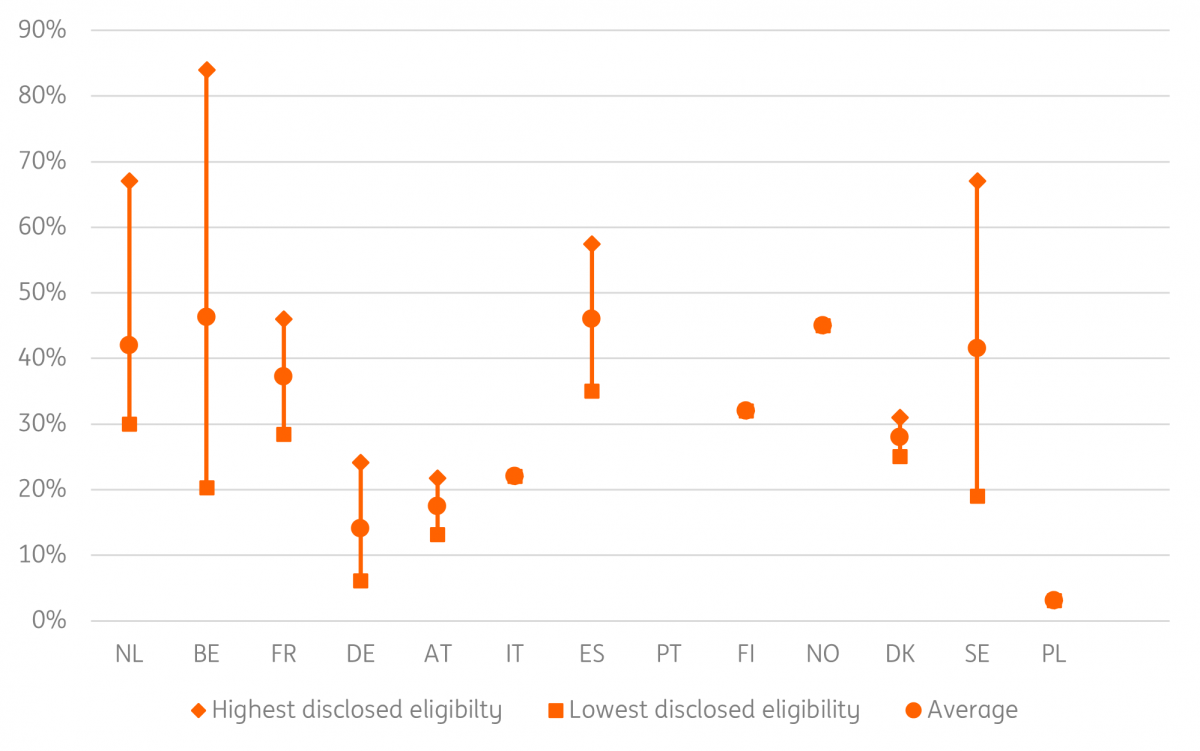

As this graph gives a first overview of the results, some important variations are detected between banks within the same country as shown below. For example, the Belgian eligibility rate varies between 20% and 83% in taxonomy-eligible assets. The same pattern is seen in Sweden where banks reported taxonomy-eligible asset shares between 19% and 67%.

The main explanation for such differences comes from the structure of the assets on the balance sheet of each bank. Currently, for corporate exposures, only the NFRD assets are considered in the eligibility criteria for green asset ratio calculation purposes thus, banks with a portfolio mainly built of real estate will disclose higher taxonomy-eligible rates than banks active mainly in the corporate lending sector.

National differences in taxonomy-eligible assets disclosed

In light of these differences and considering the taxonomy's future increase in scope, looking into the share of non-financial counterparties not subject to the NFRD is also interesting. Indeed, this category includes a wide range of companies from medium to listed SMEs which will gradually be included in the CSRD. Accordingly, these will also gradually be included in the taxonomy-eligible and possibly taxonomy-aligned part of banks’ portfolios.

When we look back at the average disclosure of non-financial counterparties not subject to the NFRD by country, as most countries display, on average, a rate of eligible assets within the 30-40% range, the ones with lower rates have higher exposures to non-NFRD companies. Hence, with time, we can expect to see a shift in banks' taxonomy-alignment results towards higher rates simply with the inclusion of these activities in the calculation. Furthermore, banks that currently have low eligible assets but a high non-NFRD share will, as of 2026, catch up on their taxonomy eligibility and alignment share. Currently, however, results clearly are in favour of institutions with a larger share of the portfolio derived from mortgages.

However, the European Banking Authority (EBA) aims to ensure that banks, in their pillar 3 disclosure requirements (CRR), have the opportunity to extend their taxonomy reporting to smaller corporates with the Banking Book Taxonomy Alignment Ratio (BTAR) that will be enforced mid-2024. It is nonetheless expected that the GAR will become the predominant KPI in the long term as its scope will increase. Furthermore, some investors are already using the GAR as a reference to report their share of taxonomy-eligible assets.

What's next for banks?

The evolution of regulatory requirements over sustainability poses both short and long-term challenges for financial institutions. As banks still have a year before the disclosure of their taxonomy-aligned portfolio and a bit more before the entry into force of BTAR, data availability still remains an important issue. For companies not subject to the NFRD, the EBA recommends banks collect information on a bilateral basis in addition to the use of proxies. As for real estate, Energy Performance Certificate (EPC) labels for buildings will be required and no proxies will be allowed. To disclose on these two points the need for data is key. However, up to now, the availability and quality of data often raise questions. As BTAR offers some flexibility on the disclosures for small companies on a “best effort” basis, this will not be the case for real estate in the taxonomy-alignment disclosure.

EPC labels are a significant issue for credit institutions as countries have very different requirements when it comes to the obtention and disclosure of these certificates; most national regulations do not require homeowners to obtain an EPC label and when they do, the grading scheme varies between regions. The taxonomy requires real estate built before the end of 2020 to have an EPC label A or be part of the top 15% of most energy-efficient estate in the country. The second part of the criteria gives some flexibility to financial institutions. However, most banks still lack information on most of their portfolio and without the possibility to use proxies will not be able to fully report on it.

The issue of data availability also arises when it comes to company disclosures. As large companies can invest in their reporting, smaller businesses, on which banks will be required to disclose as of January 2027, might not be able to provide the necessary information. Thus, banks will need to find alternative solutions to comply with the disclosure requirements.

Another important impediment arises for banks: the understanding of disclosure requirements

On top of the data challenge, another important impediment arises for banks: the understanding of disclosure requirements. The taxonomy requires companies' activities to comply with applicable technical screening criteria to be labelled as aligned. The level of detail of these criteria implies significant costs and time investment to be correctly implemented. This new regulation also forces credit institutions to rely on a constant back and forth with the European Commission to ensure the correct understanding of requirements. As this poses a short-term adjustment risk, it is expected to lessen with time and once the first disclosures are made and banks' experience grows.

Another significant, and often underestimated, adjustment risk implied by these new disclosures is the lack of adequate IT tools such as data storage. As both directives (NFRD and CSRD) and the taxonomy push banks to gather new data and to report on it, IT and reporting systems are impacted. Adjusting to these new compliance criteria involves the creation of storage locations in the case of new data points but also simply IT systems to access the existing data.

On top of technical changes, investment in human capital will also be required as new information needs to be reported. Training on both the requirements and information at hand will need to be provided, so adding to data investments that banks will have to do to efficiently comply with the new regulations.

As these dilemmas are expected to be solved with the first disclosures and by building experience, we can see that requirements on ESG and sustainability-related topics will keep evolving and adjusting. One of the most predictable, and still unfolding issues concerns the scope of the taxonomy. Indeed, as the current directive focuses on setting and unifying green products, this black-and-white vision of society should evolve to a more inclusive representation by including significantly harmful activities (carbon intensive) and activities with no significant impact (carbon neutral). This would allow us to better understand companies’ actions and further encourage the transition towards sustainability. However, as only two of the six taxonomy environmental objectives currently have technical screening criteria, the European Union will first have to complete the necessary criteria for the objectives before turning to a more complete approach to sustainable activities' classification.

Tags

Bank Outlook 2023Download

Download article

1 November 2022

Banks Outlook: The major challenges and opportunities for 2023 This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more