Bank of Canada preview: 50bp rate hike and quantitative tightening on the cards

Canada has recovered all output lost during the pandemic while employment is at all-time highs and inflation is running at the fastest rate since 1991. A 50bp rate hike next week and quantitative tightening are on the cards. CAD may not benefit immediately from the hike – which is fully priced in – but should stay supported beyond the very short term

Jobs at a new high

Canada’s March jobs report has cemented expectations for a 50bp interest rate hike at next week’s Bank of Canada policy meeting. Employment rose 72,500 versus the expected 79,900, but this leaves total employment 442,000 higher than the February 2020 pre-pandemic level. Meanwhile, the unemployment rate fell to 5.3%, the lowest level since the series began in 1976, and wages moved higher too.

Canada employment levels versus the US

50bp hike and quantitative tightening

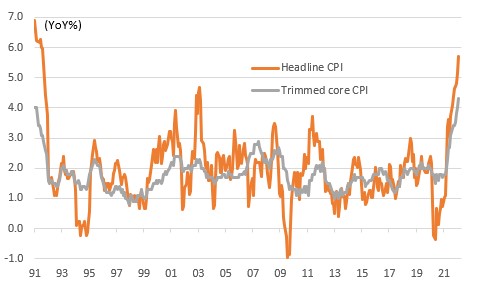

With inflation at 30-year highs and the economy having fully recovered all the pandemic-related lost output, a 50bp rate hike looks odds-on next week. The economy is in a strong position with a red hot property market adding to overheating concerns while the significant commodity production story also suggests it can continue to outperform most other major economies. At the same time, rising inflation expectations were apparent in Bank of Canada's (BoC) business outlook survey and the commentary from BoC officials have signalled a desire to get policy much tighter.

The Bank may also announce quantitative tightening (QT) next week. Comments from BoC Governor Tiff Macklem in March indicated that BoC may simply end reinvestments of maturing assets rather than the Fed’s proposed “phased in” caps for what is allowed to roll off the balance sheet. With more than a third of BoC’s asset holdings having a maturity of two years or less, we could see the BoC’s balance sheet shrink far more quickly than the Fed’s which is proposing shrinking its balance sheet by $95bn (or around 1% of the balance sheet) per month.

We expect the strong growth, strong jobs, strong property market and ongoing inflation risks to result in BoC hiking rates to 2.75% by year-end, from the current 0.5% level, with risks skewed to the upside.

Canadian inflation (YoY%)

CAD: Benefits of BoC tightening to emerge in time

After having briefly traded close to the 1.2400 gauge, USD/CAD has rebounded due to oil prices losing momentum and idiosyncratic US dollar strength. Incidentally, the pair had fallen into undervalued territory according to our short-term fair value model, and the correction higher was likely warranted.

Indeed, markets are fully pricing in a 50bp rate hike by BoC next week, which suggests a somewhat limited upside potential in the immediate aftermath of the policy statement. Still, looking beyond the very short term, the notion of front-loaded monetary tightening combined with strong economic fundamentals and – above all – a supportive external environment thanks to high oil and gas prices should all combine to keep the Canadian dollar attractive.

We expect to see a gradual depreciation in USD/CAD in the remainder of the year to reach the 1.20-1.23 area in the second half of 2022. In the shorter run, we think CAD’s strength may emerge primarily in the crosses – especially against the low-yielders – as the Fed’s own frontloading of rate hikes should put a floor below USD into the summer. EUR/CAD, in particular, could continue to grind lower and may soon test the 2015 1.32 lows. CAD/JPY may break above 100 in the near term, also a level last seen in 2015.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more