Bank of Canada hold in January, here’s three reasons why

In a nutshell, the economy is performing well overall, but the current risk environment has edged the central bank to side with caution and leave the policy rate unchanged at today's meeting. This allows the bank more time to assess the outlook before its next hike, with the most likely case this coming in July

Following a more dovish tone in December, and softening economic momentum (perhaps more so than expected), the Bank of Canada (BoC) held rates at 1.75% in its policy meeting today. Despite some disappointing data releases recently, we believe the central bank will resume its tightening cycle in the second quarter of 2019. This could be as soon as April, but more likely July - should the Fed hike in June as we predict.

| 1.75% |

Bank of Canada Policy RateUnchanged |

From the last monetary policy report in October, the central bank revised 2019 growth and inflation downward by 0.4% and 0.3% respectively, bringing both to an annual figure of 1.7%. The bank's tone today was again on the dovish side. In summary, the press release reiterated what was said last month, stating that "The appropriate pace of rate increases will depend on how the outlook evolves".

Three factors that pushed the bank to pause – for now

It's been a difficult quarter for commodity-heavy economies

World oil prices fell back sharply in the last few months of 2018, particularly in Western Canada. In turn, headline inflation figures were much lower than expected (1.7% YoY in November). Although the Bank of Canada’s (BoC) focus is typically on core inflation measures – which have been sticking around the bank's 2% target, the associated negative effect between low oil prices and Canada’s energy sector will have edged policymakers towards caution.

Things are looking up more recently though. Within the recent agreement from OPEC+ to curb oil production was a sizeable production cut from Alberta. Now, as much as this isn’t brilliant news for the energy’s sector’s contribution to Canadian GDP – we have revised our 2019 growth outlook down to 1.8% in correspondence, it has supported oil prices in Western Canada. Optimism surrounding a US-China trade resolution has also encouraged a rebound in oil prices.

Trade tensions persist

There has been some positive noise around the US-China trade talks in the new year, but until we get a concrete agreement around a deal - or at least an extended truce, equity markets, oil prices (and thus the CAD) all remain vulnerable. It is likely policymakers will prefer a few more months to assess the outlook.

Poor business activity

Growth in the third quarter of 2018 (2%) had less momentum relative to the previous quarter. This was largely expected, but lower than anticipated business spending was a downside surprise. We also are yet to see the long-awaited wage growth pick-up, which stayed at 1.5% in December for full-time workers. While we see promising signs going forward, the data does not support a hike as of yet. In the BoC’s most recent Business Outlook Survey, firms reported pushing wages higher will be one of their strategies to attract workers seeing as labour-related production constraints frequently came up as an issue.

Minimal movement from the loonie

Markets were heavily priced for the BoC to remain on hold and the bank’s tone and updated forecast were also largely in line with expectations. It was hard to discern a direct CAD reaction to the release, with $/CAD caught in the cross-fire of a broadly softer dollar and volatile crude prices.

USD/CAD has come off its recent 1.36 peak - in large part due to the rally in oil prices, but we see medium-term movement contained around the 1.33 area. The next CAD upside should arrive when the market sees the door back open for the BoC to proceed in tightening policy rates. As mentioned above, the most likely scenario is that the Bank of Canada hikes in July. In this case we’d expect USD/CAD to trend back towards the 1.27 area by the summer.

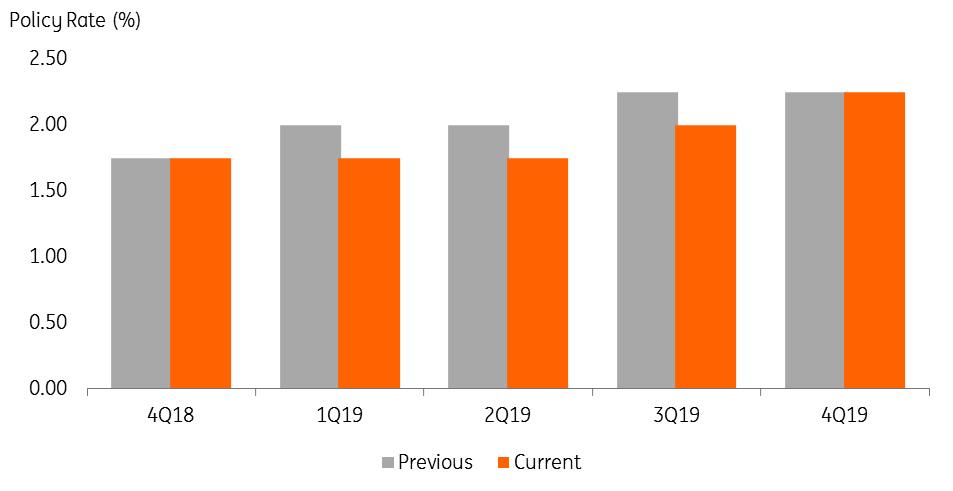

We have moderated our rate hike expectations

Despite headwinds, the economy is still performing well overall

Unemployment is at a 40-year low, core inflation measures sit around the banks 2% target and the BoC are still confident that the policy rate needs to move towards their neutral range (2.5%-3.5%, based on at-target inflation) given the economy is operating close to its potential.

Our forecasted pace of rate hikes have been revised down slightly in light of the risk environment and the expected slower pace of Fed policy tightening, but we still see hikes in 2019 - now in both the third and fourth quarter.

Download

Download article"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).