Bank of Canada hikes by a further 75bp

The Bank of Canada continues to worry about excess demand and elevated inflation expectations despite recent weaker inflation and GDP readings. Further hikes are coming, but likely at a slower pace with the policy rate set to hit 4% before year-end. There is some room for a hawkish repricing, but benefits for CAD should not be seen in the near term

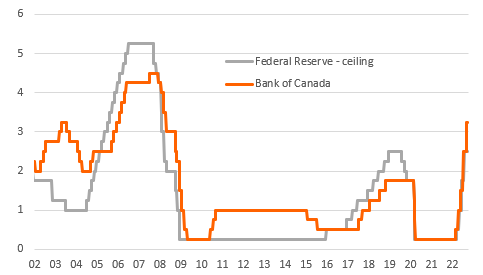

BoC raises rates to 3.25%

The Bank of Canada (BoC) has raised its policy rate by 75bp to 3.25%, as was widely expected. This follows a surprise 100bp hike in July and brings the cumulative policy tightening to 300bp since February.

While acknowledging that inflation slowed to 7.6% last month and that second-quarter GDP growth was less than expected at 3.3%, the BoC argues that the economy continues to experience “excess demand” and a tight labour market. Moreover, while GDP did undershoot forecasts, this was more trade-related and residential construction-related with consumer spending and business investment looking “very strong”. Meanwhile, core inflation continues to rise with the data indicating a “further broadening of price pressures”.

BoC versus Federal Reserve policy rates

4% expected by year end

The BoC also remains deeply nervous about elevated inflation expectations, which if persist creates a “greater risk that elevated inflation becomes entrenched”. Consequently, the BoC “judges that the policy interest rate will need to rise further”.

The policy rate is now above the “neutral rate”, assumed to be in the 2-3% range by the Bank of Canada. But with inflation well above target, the economy continuing to experience “excess demand”, and policy only mildly restrictive, we expect a further 75bp of hikes by year-end. This will take the policy rate to 4% and we believe this will mark the peak. A deteriorating global outlook and signs of weakness in the housing market, which will be intensified by additional rate hikes, are likely to lead to a slowdown in Canadian economic activity. With inflation also expected to gradually subside through 2023, we are looking for BoC rate cuts in late 2023.

CAD: Limited benefits from a hawkish BoC in the near term

Today’s BoC move and rhetoric were largely in line with the market’s expectations, and USD/CAD is trading only slightly lower following the announcement after a strong session for the pair as oil prices remained pressured. We see some room for further hawkish repricing in the CAD swap curve from now on as our call for 75bp worth of extra tightening (so rates being hiked to 4.0%) is above the peak rate expected by markets (3.8%).

Indeed, the positive implications from a hawkish BoC are nearly absent in USD/CAD price action at the moment, as external woes (oil, risk sentiment, USD strength) are dominating. This may continue to be the case in the near term, but we continue to see room for a return to 1.25 in USD/CAD by early next year thanks to the loonie’s rate and fundamental attractiveness, along with some weakening of USD.

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more