Asia week ahead: Waning growth optimism

Top policymakers in Korea warn against a potential economic downturn, though we think this won't just be limited to Korea

Waning optimism on Korea economy

Bank of Korea’s Governor Lee Ju-yeol has just sounded caution on the economy, citing uncertainties about monetary policy normalisation by major central banks and trade tensions, as well as a weak labour market domestically. And he isn’t alone, the vice chairman of Korea’s National Economic Advisory Council, Kim Kwang-doo, has also warned of a potential slump. This follows North Korea withdrawing from the peace talks with the South this week, and probably with the US at the summit next month.

While nobody is forecasting the Bank of Korea to change the policy at its meeting next week (24 May), the dovish remarks by top policymakers raise odds against further policy normalisation later in the year. We are reviewing our view of one 25bp BoK rate hike in the second half of the year.

Judging from the 2.8% GDP growth, Korea’s economic performance hasn’t been any outstanding, despite sustained export strength this year albeit narrowly-based in the semiconductor sector. Besides, the contagious financial asset selloff elsewhere will carry some weight in the central bank policymaking. It’s not all about changing the policy interest rates though. A move to greater transparency about the exchange market intervention starting the second half of 2018 is a welcome development in stemming some currency volatility.

Moderating growth elsewhere in Asia

April industrial production data in Singapore and Taiwan will inform on GDP growth of these economies coming into the second quarter of the year. Exports drive industrial production. But electronics exports, the mainstay of Taiwan and Singapore’s exports, have already started to weaken. Like Korea, the downside growth risk for other Asian economies is rising. We have recently revised our forecast for Taiwan GDP growth in 2018 to 2.6% from 3.2%.

Thailand reports GDP data for 1Q18 on Monday (21 May). The authorities are still optimistic about growth accelerating further this year, though they may be disappointed by the GDP slowdown which we predict based on manufacturing slowdown in the last quarter. We forecast a 3.6% GDP growth in 1Q18, down from 4.0% 4Q17.

Inflation not an issue for most of Asia

In an environment of rising growth risk, inflation data will come under scrutiny for monetary accommodation. Hong Kong, Singapore, and Malaysia report consumer price data for April.

China’s inflation dip in April points to the same for Hong Kong, thanks to transmission of lower food prices from the mainland. Inflation hasn’t been a policy worry in Singapore and with the central bank tightening in April, it’s unlikely to be one anytime soon. In Malaysia, the reduction of the Good and Services Tax to zero rate heralds a prolonged period of low inflation ahead. But we continue to anticipate Malaysia's central bank (BNM) normalising policy, with a further 25bp rate hike in 3Q18.

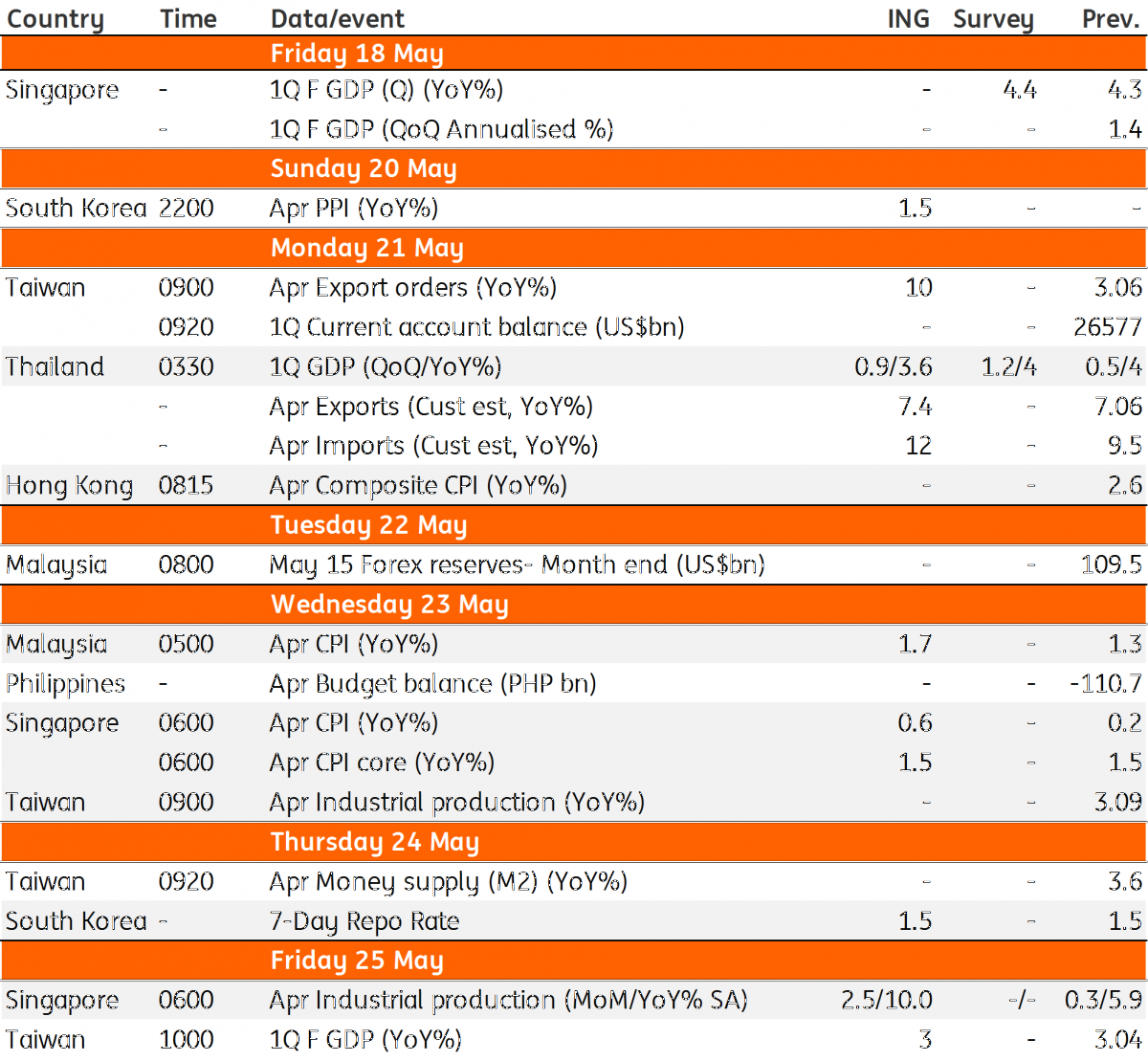

Asia Economic Calendar

Download

Download article18 May 2018

Our view on next week’s key events This bundle contains {bundle_entries}{/bundle_entries} articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).