Asia week ahead: Heading towards double-digit growth

Strong economic activity in China aligns with expectations of double-digit GDP growth this quarter, and we have similar expectations for most Asian economies in the second quarter too. Having said that, regional central banks still don't have enough ammunition to relax their guards just yet

Growth getting boost from the low base effect

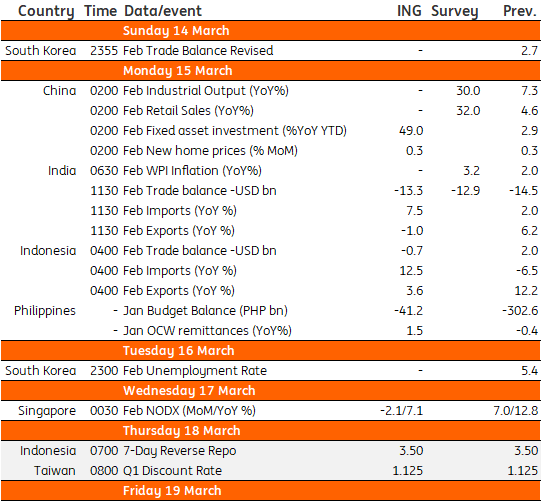

Next week kicks off with China’s February data on industrial production, fixed-asset investment, retail sales, and home prices.

The trade figures, released earlier this month showed a solid 61% year-on-year bounce in exports in the first two months of 2021, which tells us that all is going exceptionally well as far as the post-pandemic economic recovery is concerned. The forthcoming releases are widely expected to carry this story forward with the exception of home prices, which are really the only indicator for which YoY growth will still be in the single digits.

Strong activity bounce is keeping regional economies firmly on track to achieve double-digit GDP growth...

In reality, this strong activity bounce tells us more about what happened a year ago than what's going on currently. The crash in activity last year is swelling the year-on-year comparisons but it’s not all about base effects. The underlying recovery also has been seen some momentum, gauging from rising consumer and business confidence around the region as well as the ongoing re-pricing in the market with a sell-off of the safe-haven treasury bonds.

Trade figures from India, Indonesia, Japan and Singapore and Australia's labour report - all for February, will shed more light on this.

... though this tells us more about what happened a year ago than what's going on currently.

All this is keeping regional economies firmly on track to double-digit GDP growth imminently – and China will be the first in Asia to see it in the current quarter (ING forecast 12% YoY) and the majority of other Asian economies are likely to follow suit in the second quarter. Of course, this is going to be a brief phase of ultra-strong GDP growth – not more than a quarter at most, and soon to fade base effect should push things back to more normal single-digit growth very soon.

In some cases, it might even be below normal, like Thailand which is a heavily tourism-dependent economy.

Monetary policies have nowhere to go... yet

In the last few months, aside from minor tweaks, central bank meetings have become rather uninspiring events mainly for two reasons. Policy easing has almost reached its limit, and the post-Covid-19 recovery isn’t quite in the bag just yet to start raising rates again.

The fact that we have three central bank meetings next week in Indonesia, Japan and Taiwan, and we anticipate no changes to the main policy rates makes the point quite well.

Recent surge in 10-year JGB yields has aroused market interest in the next week's BoJ policy meeting.

That said, there has been some pending market interest in the Bank of Japan’s policy after the recent surge in bond yields. With the policy rate below zero for years, the central bank is usually left adjusting the policy via bond purchases or yield curve control. Speculation seems to be rife about tweaks to the policy band for the 10-year Japanese government bond yields, currently implied to be 40 basis point around the 0% target (20bp on either side), as the yield pushed near the top end of the policy band.

Adding to the speculation were Governor Haruhiko Kuroda’s comments last week that emphasised the need to keep the borrowing cost low to support recovery. Market chatter suggests a possible widening of the trading band, allowing the 10-year yield to fluctuate more freely.

Whether Japan's central bank ends up taking that route and the extent it helps to push yields back down to 0% remains to be seen.

Asia Economic Calendar

Tags

Asia week aheadDownload

Download article12 March 2021

Our view on next week’s key events This bundle contains {bundle_entries}{/bundle_entries} articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).