Asia week ahead: Indian budget steals focus

The trade and purchasing manager indexes (PMIs) from across Asia may reveal that 2019 isn’t off to a good start for regional economies, arguing for continued policy stimulus. India’s FY2019-20 budget will be a closely-watched event as the Modi government aims to boost economic growth in its bid for re-election

Indian government unveils an election budget

India’s interim finance minister Piyush Goyal presents the FY2019-20 budget to the parliament on Friday, 1 February (Arun Jaitley is reportedly on medical leave). Growth will outweigh fiscal discipline as the Modi administration pushes its way for a second term in the general election scheduled for May this year.

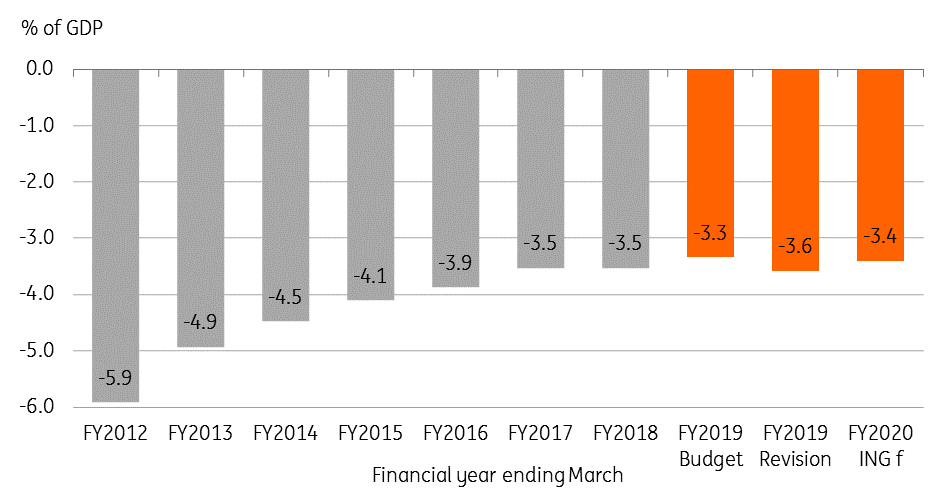

As such, after an overshoot of the deficit in the last financial year and more likely again in the current year, hopes of any fiscal consolidation taking place in the next financial year are largely misplaced. We see the revised budget for current FY2018-19 producing a deficit equivalent to 3.6% of GDP, well above the government's initial projection of 3.3% (consensus 3.5%). Our deficit forecast for the next financial year is 3.4%.

Persistently weak public finances will keep local government bonds and the Indian rupee under weakening pressure.

India: Fiscal deficit - derailed consolidation

Export weakness weighs on manufacturing

The trade and PMI releases from the rest of the region will likely reinforce the export-led slowdown in manufacturing coming into 2019 – not a good start to the year.

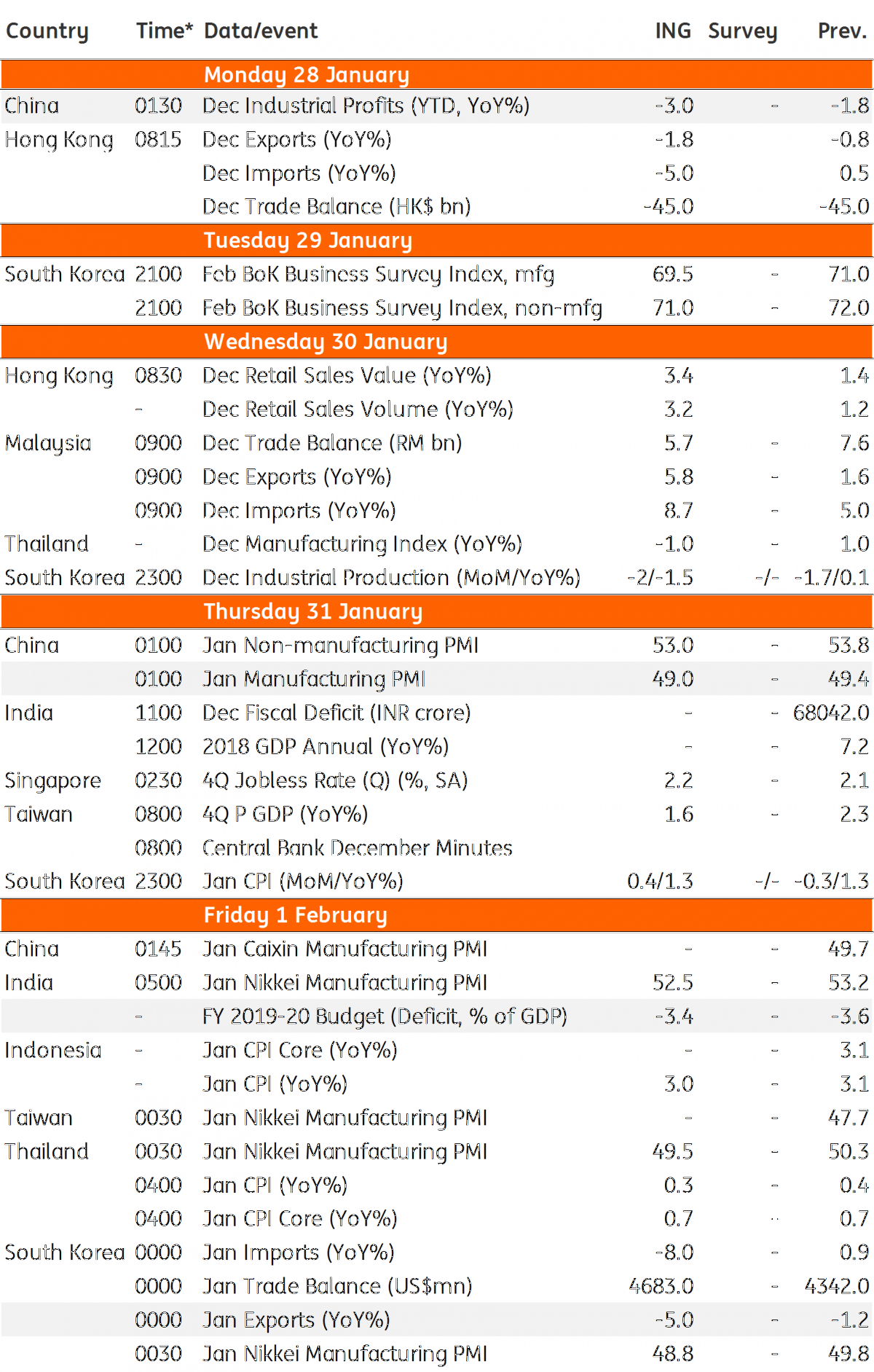

China’s PMI will be closely watched. The manufacturing index fell below 50 in December for the first time since mid-2016, indicating contraction in activity, while services continued to grow. We aren’t anticipating any bounce in activity in January, though the front-loading for the Lunar New Year holiday, which falls in the first week February, leaves scope for an upside surprise. Moreover, China’s industrial profits data paints a clearer picture. Profits ended 2018 with negative growth and 2019 has seen a weak start as well.

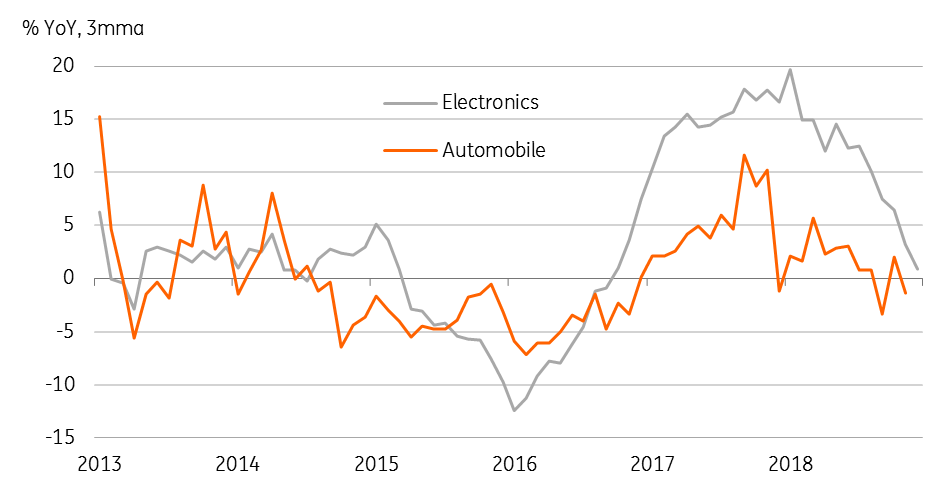

Korea’s trade for January, the first trade data from the region and probably from the world, is expected to show the deepening of export weakness as the downturn in global electronics and the automobile sector and a slowdown in China dampened export demand.

Asia: Electronics and autom

Asia Economic Calendar

Tags

Asia week aheadDownload

Download article25 January 2019

Our view on next week’s key events This bundle contains {bundle_entries}{/bundle_entries} articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).