Asia week ahead: How bad was 1Q20 for China’s economy?

China’s GDP report for the first quarter will provide some sense of the damage the pandemic has inflicted on economies in that part of the world

China – 1Q20 report card arrives

While the economic data for March substantiates this view of the Chinese economy getting somewhat back on its feet, China’s GDP report for the first quarter of the year due next week on 17 April will come as a testimony of the real dent to the economy due to the pandemic.

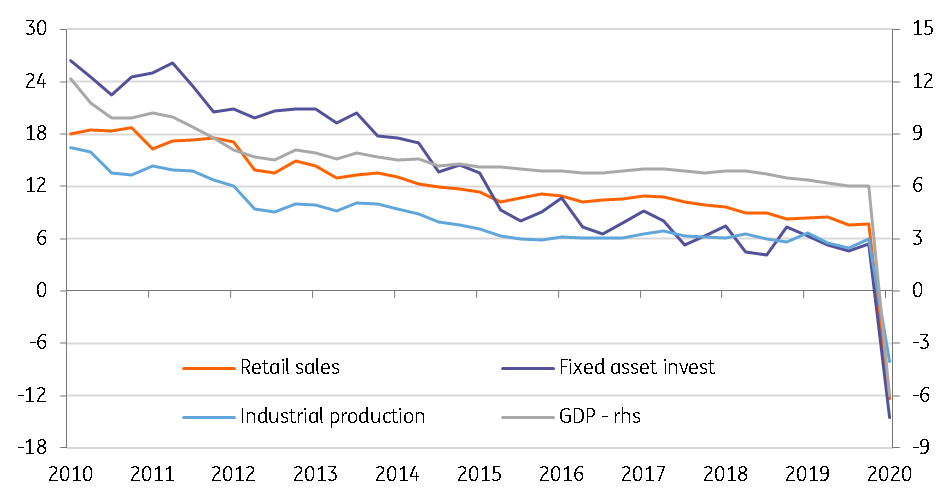

The consensus at the time of writing this is 6% year-on-year GDP fall, the country’s worst performance in six decades. This is drawn out from expectations of continued contraction in key indicators – industrial production, retail sales and fixed asset investment, for which March data also is due alongside the GDP release. In contrast, our Greater China Economist, Iris Pang, sees GDP growth staying in the positive territory, albeit a sharp slowdown to 3.6% YoY from 6% in 4Q19. This is based on her view that fiscal stimulus prevented a pronounced recession.

However, the key unknown here is a drop in overseas demand for Chinese goods, which with the ongoing global spread of the disease will remain a key drag on GDP growth for the remainder of the year. Read here what Iris thinks about China’s recovery roadmap.

China: GDP and other key indicators (% year-on-year, quarterly data)

Rest of Asia – Trade figures, policy dominate

Trade figures from India, Indonesia and Singapore will be assessed for the Covid-19 impact. A sharp decline in exports is our base case, at least for India and Singapore with close to 20% YoY plunge, as movement restrictions depressed activity. Singapore’s non-oil domestic exports will be a test of the resilient manufacturing in the first quarter with only 0.5% YoY fall in the advance GDP data for the quarter.

In India, the government is expected to announce additional stimulus for small businesses severely affected by the ongoing lockdown. The market talk is about $13 billion (0.5% of GDP), taking the total stimulus to about 3.2% of GDP which is no comparison to the 10-20% figure, we've seen in some other Asian countries. We don’t think it will make much of a difference to the economy. We expect GDP growth to fall by as much as 5% YoY in the current quarter, but we won't rule out more too.

Meanwhile, India’s consumer price data for March may be scrutinised for the easing options the Reserve Bank of India is left with after the 75 basis point emergency rate cut last month, which was despite high inflation above the RBI’s 6% policy limit. We expect high food prices, amid a surge in demand, possible hoarding, and supply bottlenecks during the lockdown to continue to exert upward pressure. This counter disinflationary effect of falling global oil price on utility and transport components. That said, we don’t see inflation stopping the RBI from cutting rates again. We anticipate an additional 25-50bp rate cut in this quarter.

Will Indonesia’s central bank cut rates at the next policy meeting? We're not forecasting one, but won't be surprised if we get another 25bp cut from the current 4.5%. Weak currency with over 13% year-to-date depreciation, the most in Asia, complicates BI policymaking when the economy is demanding greater policy accommodation.

Download

Download article

13 April 2020

Good MornING Asia - 13 April 2020 This bundle contains {bundle_entries}{/bundle_entries} articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).