Asia week ahead: Economies in need of more policy thrust

While some Asian central banks are gearing up to provide more policy thrust to growth amid prevailing low inflation, some are not there just yet. Indonesia’s central bank is in the latter camp, though it's meeting next week might not be a total non-event

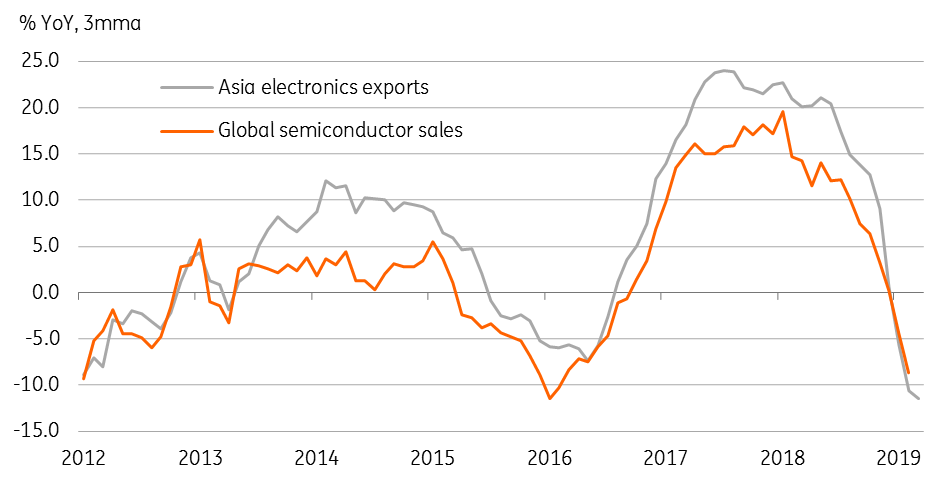

Global tech slump weighs on growth

Trade, manufacturing, and inflation figures due from Asia next week are expected to reinforce the prevailing trends of slow growth and low inflation in most of the region.

China’s steady GDP growth points to reduced headwinds for the rest of Asia's growth from the ongoing US-China trade tensions, as the news flow on trade negotiations continues to be positive. However, the continued downturn in global technology demand appears to be an increasing drag on regional exports and growth. Trade figures from Taiwan and Thailand may take this story forward.

Falling global semiconductor sales

Potential candidates for easing

Singapore was in the limelight this week for 1Q19 GDP and central bank policy, and an ugly export surprise. Next week brings the city-state’s manufacturing data for March, which should act as a guide of the possible direction of revision in the 1.3% advance GDP estimate, which was the slowest rate of growth in over three years.

And judging from the dismal export figures for March, this direction could be more on the downside than upside. If so, the odds of MAS policy easing in October will increase.

Malaysia’s consumer price data for March is also likely to make headlines, possibly for yet another downside surprise. Inflation slipped into negative territory in January and remained there in February (-0.7% year-on-year and -0.4% respectively). We don’t think price gains in March were strong enough to pull it back into positive territory, as what the consensus estimate of 0.3% YoY rise suggests. We believe the central bank will move to ease the policy by a 25bp rate cut at the next meeting in May.

Bank Indonesia isn’t there just yet

Bank Indonesia’s monetary policy board meets next week. With politics continuing to overshadow the economy, the central bank will prefer to stay on hold. While this is also a consensus view, BI statement will be closely gleaned for clues on future policy stance.

It’s not inflation that’s keeping Bank Indonesia from joining its Asia counterparts from easing policy, while growth remains stuck at the 5% level and below its potential. Rather it’s the currency instability amid the ongoing political jitters. It seems incumbent President Jokowi is set to win the second term in office. However, the political muddle is unlikely to completely clear until official results are announced. But we don't rule out the possibility of prolonged uncertainty if the opposition strongly disputes the election results.

The confirmation of Jokowi’s second term should put investor anxiety to rest and provide comfort to the central bank to consider policy easing while inflation stays close to the lower end of the 2.5-4.5% policy target.

Asia Economic Calendar

Download

Download article18 April 2019

Our view on next week’s key events This bundle contains {bundle_entries}{/bundle_entries} articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).