Asia week ahead: Philippines rate hike in view

Australia, New Zealand, Thailand and the Philippines hold central bank meetings next week but the Philippines will be the one to watch. Meanwhile, China’s July trade data should provide a glimpse into the trade war impact

| 4% |

ING forecast of BSP policy rate50bp hike from the current level |

A double-barrel tightening by Philippines' central bank

Central banks in Australia, New Zealand, Thailand and the Philippines all hold their monetary policy meetings next week, but a broad consensus forecast for no change in rates by the first three, make these non-events.

We think the Philippines central bank meeting next Thursday (9 August) will be the most significant. Coming in just ahead of the meeting will be the July inflation figures and GDP for the second quarter, which are likely to play a key role in the decision.

Rising inflation and the weak currency were triggers for the two 25 basis point rate hikes in May and June. Of these, the second factor has somewhat faded recently; not only has the peso stabilised in sync with emerging FX, but the 0.4% appreciation against the US dollar over the last month was also the most among Asian currencies. However, rising inflation remains a tailwind for higher rates, and that's getting even stronger.

Inflation surged past the central bank’s 4.3 - 5.1% forecast range to 5.2% year-on-year in June. Our Philippines economist, Joey Cuyegkeng, sees it jumping further to 5.4% in July and thinks it's unlikely to stop there. Higher minimum wages, transport fares, elevated fuel prices, income tax reforms, and the weaker currency are all likely to sustain the upward trend for the remainder of the year. And in our view, this requires more aggressive policy action.

We forecast steady, strong GDP growth of 6.7% YoY in the second-quarter - barely moving from 6.8% in 1Q and we think this provides scope for a 50 basis point hike rather than the standard 25 basis point move.

| 11.7% |

ING forecast of China's exports in JulyLittle changed pace from June |

Little impact of US tariffs on China’s exports

China’s July data dump begins next week too.

The trade and foreign reserves data will be closely watched for the trade war impact. The first phase of US tariffs covering $34 billion of Chinese goods became effective from 6 July. We think it’s premature to expect a significant impact just yet. Our Greater China economist, Iris Pang, forecasts 11.7% year-on-year growth in Chinese exports in July, little changed from June.

Our steady export growth forecast assumes that most of the trade in July was due to pre-booked orders, which were unlikely to have been cancelled due to tariffs. And, $34 billion accounts for only 8% of China’s annual exports to the US, and 1.5% of total yearly exports. The impact will be pronounced if the US moves toward $200 billion of tariffs, but that’s something for the latter part of the year.

We believe a steady 3% yuan depreciation vs the US dollar in the last month, and capital outflows associated with it, should have dragged foreign exchange reserves lower. Our forecast of $3.097 trillion reserves in for the end of July represents a $15 billion drop on the month.

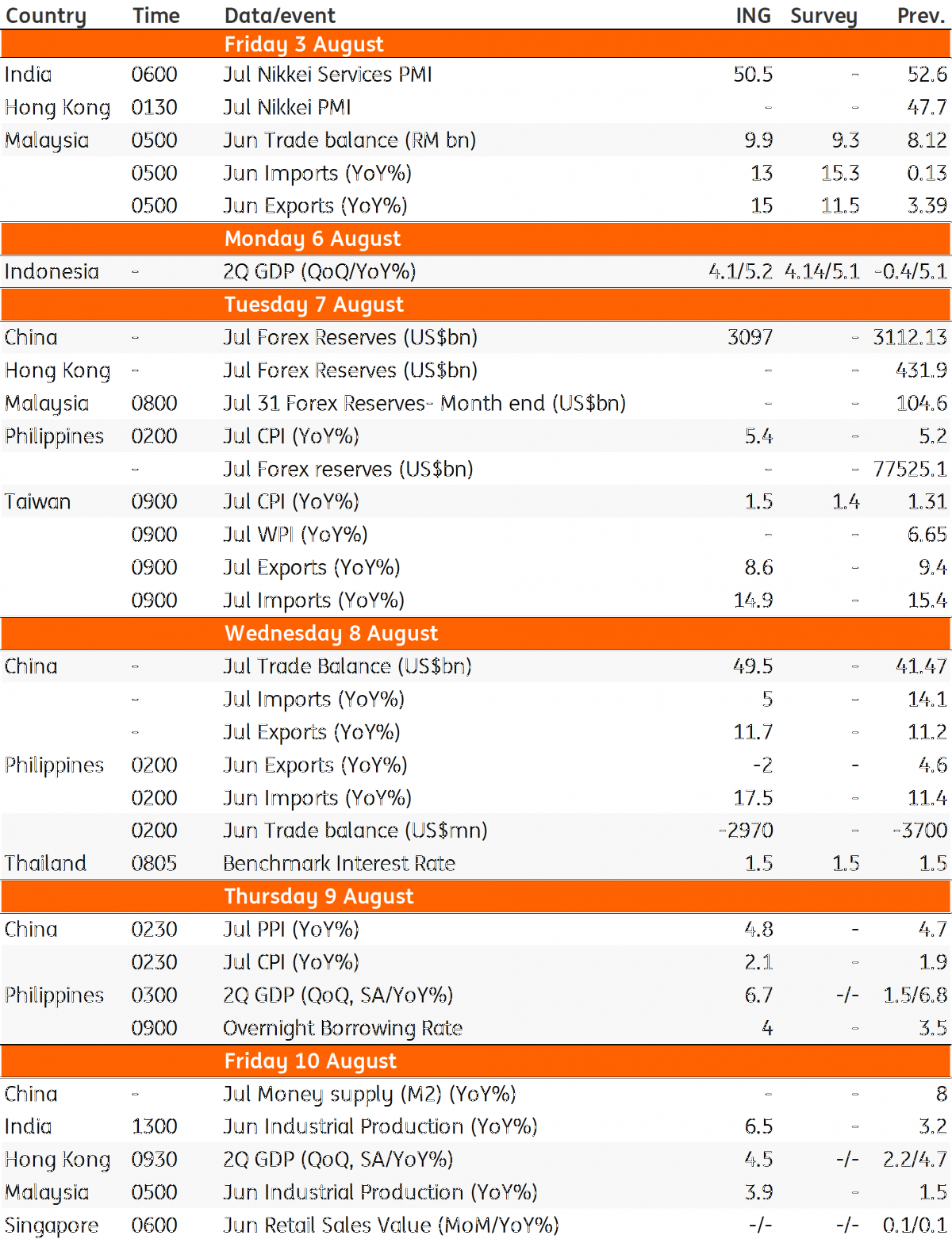

Asia Economic Calendar

Tags

Asia week aheadDownload

Download article3 August 2018

Our view on next week’s key events This bundle contains {bundle_entries}{/bundle_entries} articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).