Asia week ahead: China and India dominate

A data-packed week in China and India, but the trade war and crisis in emerging economies are likely to persist as key drivers for Asian markets

China: Economic activity apart from exports likely to show some strength

China’s August data flow begins with trade data over the weekend. Judging by the PMI new export orders component, which was below 50 for the third straight month in August, some weakness in actual shipments looks to be in order. However, Korea’s trade data for August shows that Asian exports have so far been resilient to the trade war. Although China is on the frontline in the trade war, the impact of the first $50 billion of tariffs is expected to be small. Our forecast of 7% year-on-year August export growth implies only a negligible month-on-month fall.

The other Chinese data – inflation, retail sales, fixed asset investment, industrial production, and money and bank lending – will be closely monitored for evidence of domestic policy stimulus kicking in to offset the trade drag. A higher manufacturing PMI in August is a hopeful sign of this, and it also supports our view of slightly better industrial production growth of 6.2% YoY compared to 6.0% in July.

India: Inflation genie in the bottle, but not for too long

We expect India's consumer price inflation in August to be steady at July’s 4.2% level. The favourable base-year effects in food and transport components have kept a lid on CPI inflation for now. But we can't relax just yet. A meteorological prediction of sub-normal rainfall this monsoon season raises the spectre of higher food inflation. This comes amid an administrative hike in minimum support prices for farm products. And with a steadily depreciating rupee boosting imported inflation, mainly through a surging oil import bill, it won’t be long before inflation rears its head. We aren’t ruling out a more aggressive RBI policy move at the next meeting in early October.

Also look out for India’s trade data for August and the balance of payments data for 1Q FY19 (April-June 2018). We expect the continuous widening of the current account deficit as a tailwind for a higher USD/INR rate, which we see grinding towards the 74-75 area over the next six months.

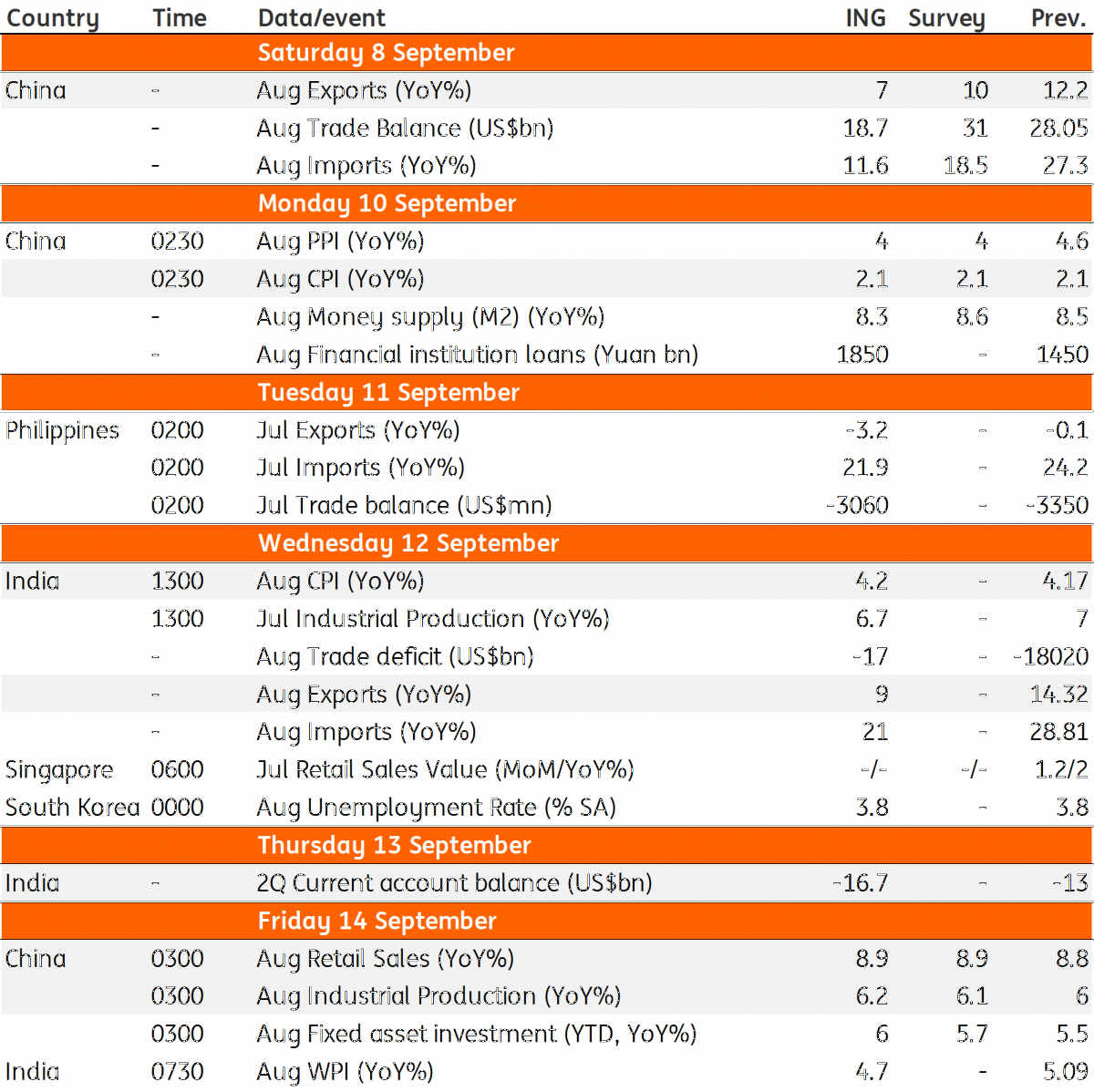

Asia Economic Calendar

Download

Download article7 September 2018

Our view on next week’s key events This bundle contains {bundle_entries}{/bundle_entries} articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).