Asia week ahead: Bank Indonesia pauses tightening

So far so good, not much of an impact of the China-US trade war on Asian exports in July. But that's no reason to relax just yet - the trade war has just started. It will take a while for the impact to trickle down to the real economy and Asia won't be immune to this

| 6.4% |

China industrial production growthING forecast for July, up from 6.0% in June |

More Chinese economic data for July

As expected, China’s July trade data showed little impact from the US-China trade war in the initial phase of $34bn of tariffs. The remaining economic data for July – industrial production, retail sales, fixed asset investment, and monetary indicators – is likely to reinforce the same message.

We increase our industrial production growth forecast to 6.4% year on year for July from the 6% in June on the back of firmer exports. Investment and monetary data will shed light on whether recent liberalisation measures in areas of financial securitisation and asset management have started showing results.

| 5.25% |

BI policy rateING forecast, no change from current level |

Indonesian central bank tightening cycle isn't over just yet

Indonesia’s central bank will hold its policy meeting next Thursday (16 August). After a cumulative 100 basis point of policy interest rate hikes in May and June, Bank Indonesia paused tightening at the July meeting. We aren’t looking for any policy moves next week, and Indonesian economic data since the July meeting supports our call. However, this doesn’t mean that the Indonesia tightening cycle is over just yet.

Most of the policy tightening so far was aimed at curbing the weakness of the Indonesia rupiah, while inflation has been running in the lower half of 2.5 - 4.5% policy target. A likely swing in the trade balance to a deficit in July from a surplus in June could reignite the currency pressure.

July trade data is also due next week (15 August). The rupiah will come under pressure once the trade war begins to hurt exports. Moreover, higher tariffs together with the currency weakness will pressure inflation higher. and we continue to expect one more 25 basis point hike later this year.

| 5.2% |

Malaysia 2Q GDP growthING forecast, down from 5.4% in 1Q |

Singapore and Malaysia report second quarter GDP

Singapore reports revised GDP figures for the second quarter. The advance estimate released in July revealed a slowdown in GDP growth to 3.8% YoY from 4.3% in the first quarter. But the subsequent data showed strong industrial production growth which leads us to revise upwards our second quarter growth to 4.0%.

But that’s not important. We think the non-oil domestic exports figure for July - the first hard activity data for the current quarter will be more significant for GDP growth amid growing global trade tensions. June NODX was exceptionally weak with 11% month on month fall (seasonally adjusted), so we expect some clawback in July.

As for Malaysia, we forecast a slowdown to 5.2% YoY in the second quarter from 5.4% in the previous quarter – which is still among the strong growth economies in Asia. We infer from widening external trade surplus that net exports, which displaced domestic demand as GDP growth driver in the first quarter, remained in the driving seat.

We think the best of GDP growth in Asian economies is over and the global trade war is going to depress growth going forward.

| 4.8% |

India CPI inflationING forecast for July, down from 5.0% in June |

Inflation and trade figures matter for India's central bank

India’s consumer prices and trade data for July are due. A likely dip in CPI inflation below 5% may come as a relief for the central bank's tightening policy. However, this tells us more about what happened a year ago than what's happening now - the high-base year effect.

We don't expect any moderation in key CPI drivers of food, fuel and transport prices. Typically, July is the month with a sharp month-on-month rise in the food components in the year.

On the trade side, the widening trade deficit trend underway since February this year looks set to remain in place. We forecast a further widening of the trade deficit to $16.9bn in July from $16.6bn in June as a result of slower export and faster import growth. Oil contributes to almost half of the trade deficit.

We don’t expect overhang on the Indian rupee from widening trade deficit and elevated inflation to lift anytime soon. Hence our forecast of continued central bank policy tightening ahead.

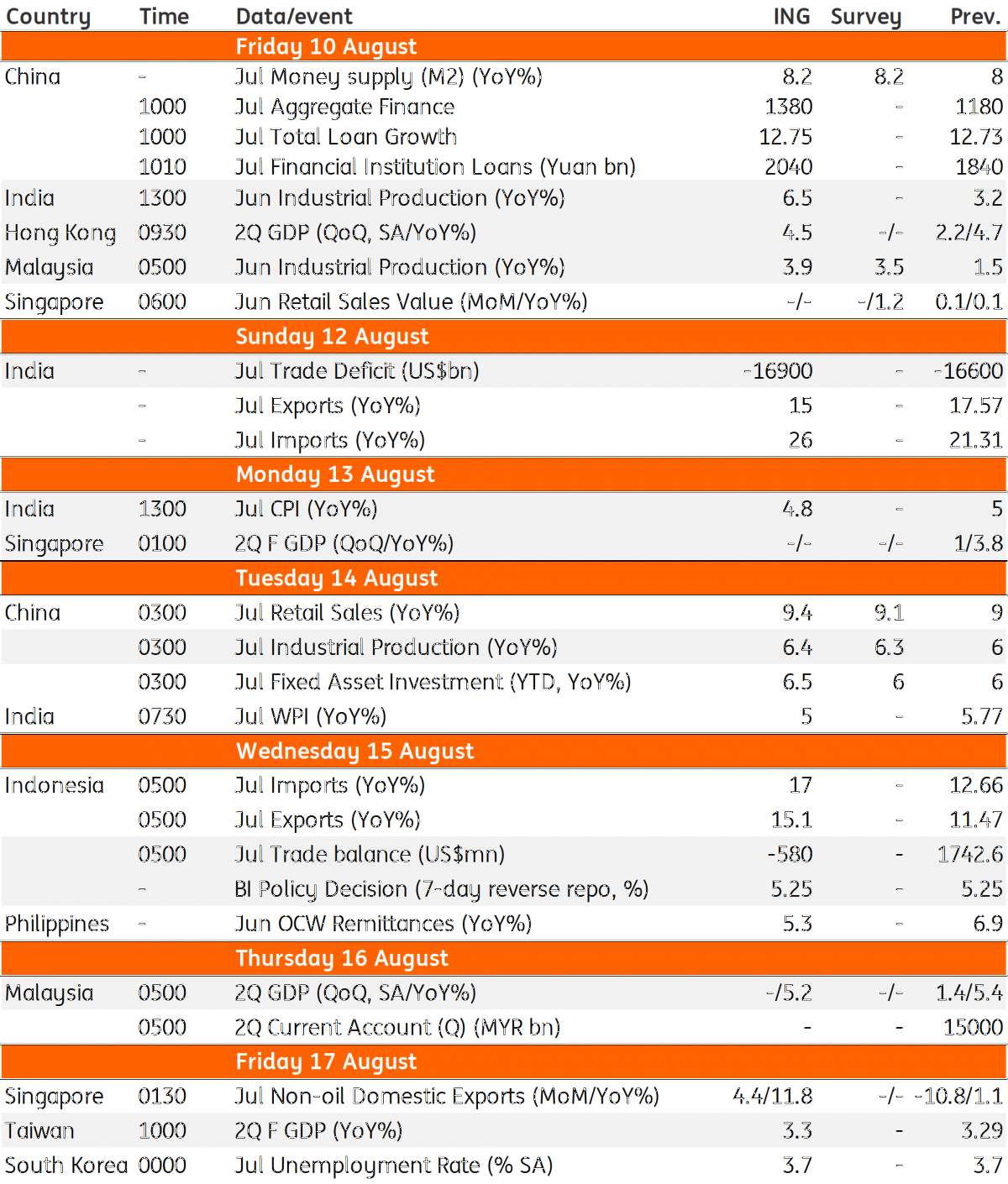

Asia Economic Calendar

Tags

Asia week aheadDownload

Download article

13 August 2018

Good MornING Asia - 13 August 2018 This bundle contains {bundle_entries}{/bundle_entries} articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).