Asia week ahead: Trade ends 2018 on a weaker note

So far, the December data out from the region has indicated that 2018 has ended on a weaker note for Asian trade. The message from the raft of trade data out next week is unlikely to be any different

Trade data dominates calendar

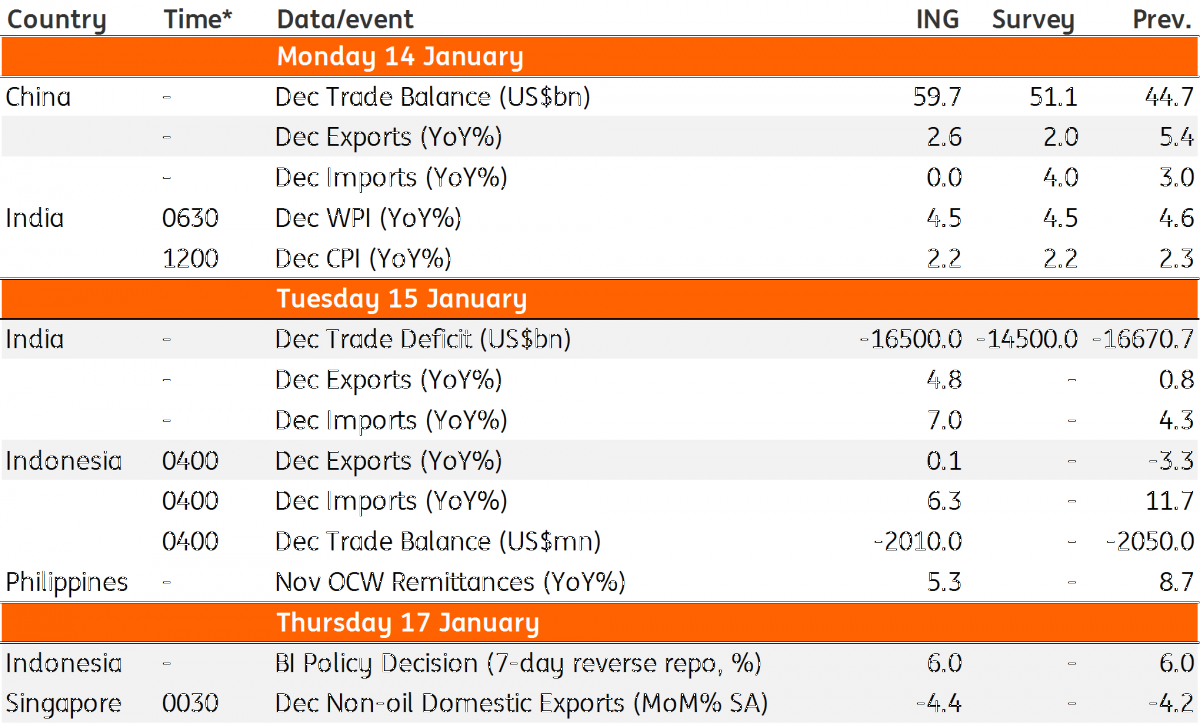

The week kicks off with trade data from China, followed by India, Indonesia, and Singapore.

Given that both, Korea and Taiwan posted negative export growth numbers last month, we can infer that the consequences of the US-China trade war are slowly working their way through the regional and expect upcoming trade releases to reinforce the impact.

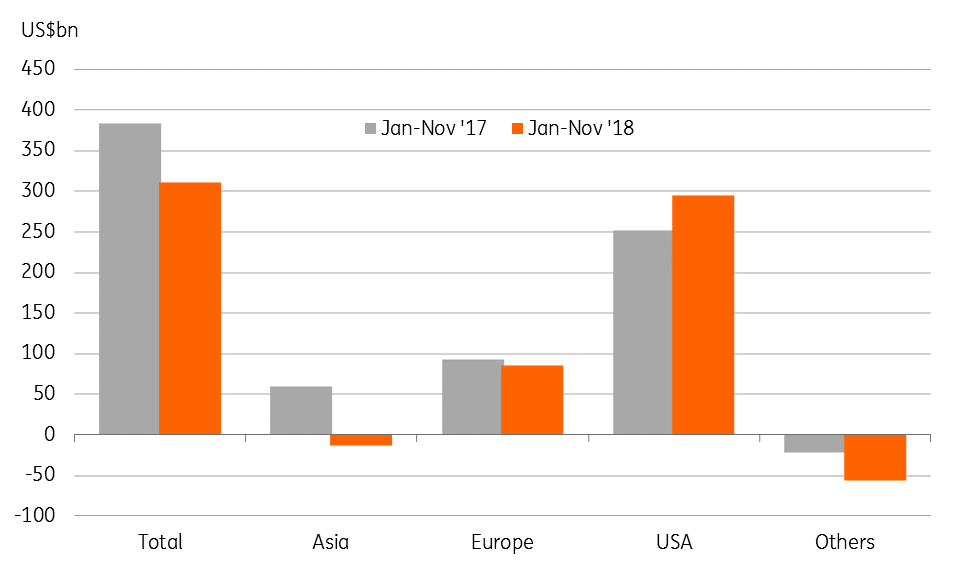

Undoubtedly, China data will be watched closely as the latest round of trade talks have ended on a positive note but without much material progress. Will there be anything in this report to cheer President Trump? Nothing really at all. Judging by China’s ongoing widening trade surplus - one month’s figures aren’t going to make any dent. China's trade surplus with the US surged 17% in the first 11 months of 2018 from a year ago even as the total trade surplus was 19% lower on the year.

China's swelling trade surplus with the US

Indonesian central bank to leave policy on hold

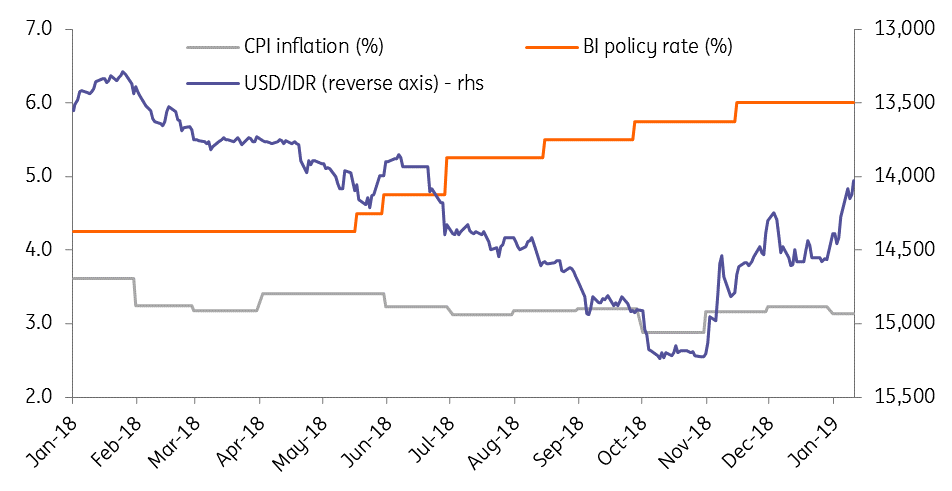

Indonesia's central bank will meet next week (17 January), and we expect another pause this month after the Bank paused tightening in December following a cumulative 175 basis point hike since last May.

The central bank's tightening was mostly geared toward supporting the currency during the emerging market volatility spikes, while inflation had been well-behaved. 2019 has started on a positive note for the Indonesian rupiah with 1.9% appreciation against the USD so far - the most among the Asian lot, warranting no change to the policy. However, the elevated trade deficit reinforces the currency's continued vulnerability to potential emerging market routs and the increased political risks domestically.

We don’t think the central bank's tightening cycle has ended just yet, which is why we forecast one more 25bp hike to 6.25% later in the current quarter before a lasting policy pause.

Indonesia's tightening cycle isn't over just yet

No respite for the Indian rupee

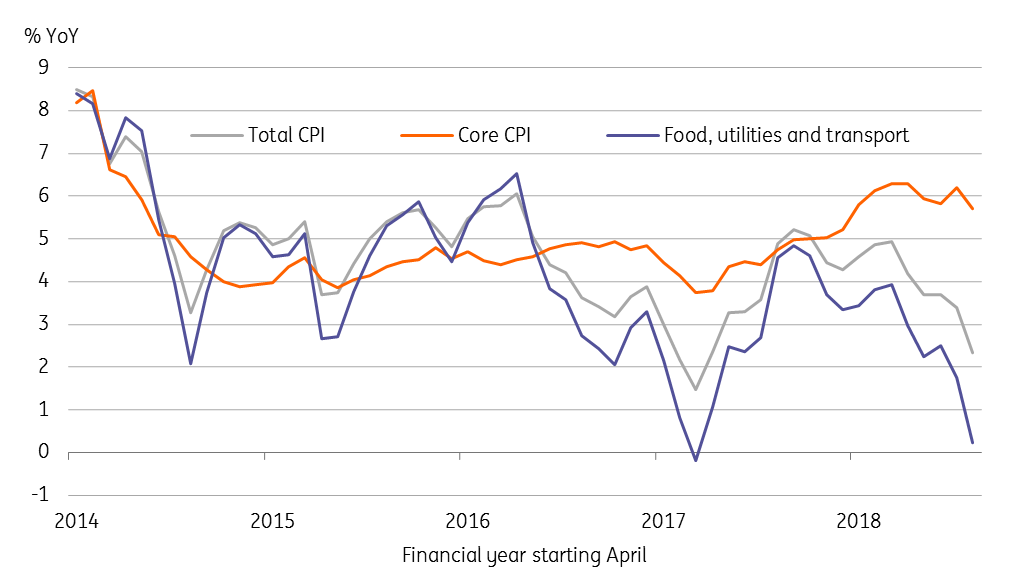

Like Indonesia, India’s high trade deficit hangs over the Indian rupee. But unlike the rupiah, the rupee retains its position of Asia’s most underperforming currency coming into 2019. And there is nothing in the forthcoming economic data altering this state of affair.

Under the new governor, the central bank of India has upped its ante towards monetary easing to boost growth as the government wants before the elections in May this year. The consumer price data continues to be friendly for such a policy shift; we estimate CPI inflation to nudge further downwards to 2.2% year-on-year on lower food and energy prices in December.

We have now come to the view that the central bank will keep rates on hold throughout 2019, revised from our earlier view of two 25bp rate hikes in the second half of 2019. However, we won’t be surprised by a cut either, given the odds of such a move before elections have now increased. We continue to see the rupee trading up to the 73 levels against the USD in this current quarter.

India: Sharp deceleration in food and energy inflation

Asia Economic Calendar

Tags

Asia week aheadDownload

Download article11 January 2019

Our view on next week’s key events This bundle contains {bundle_entries}{/bundle_entries} articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).