Arcelik justifies a more positive view

The household appliance maker is well diversified away from Turkey, has a strong, cash-rich parent and is still a market leader. Ticks a number of boxes for a more optimistic view

1Q18 earning - decent results

As expected, Q1 activity was weak following the expiry of the white goods sales tax break at end-September. Nevertheless, EBITDA was up 8% YoY to TRY523bn as the company defended its margins by hiking prices. However, dealer de-stocking caused Arcelik's working capital to rise 8% QoQ to TRY6.8bn, meaning that the working capital/sales ratio increased to 31.6%, slightly above the company’s 30% target. Higher working capital and the currency move also caused Net Debt/EBITDA to increase to 2.83x, up 30bp QoQ.

Arcelik returns to normal

- Net profit declined 26% to TRY178m on currency effects.

- Domestic sales were weak, as the end of the tax break led to -25% YoY unit growth in 1Q18. Overall, FY17 domestic revenues decreased by 2.7%, while the International segment improved 26% due to acquisitions (Dawlance) and the currency effect (weak EUR/USD as well as weak USD/TRY), with a sluggish performance in Western Europe offset by a more dynamic performance in Eastern Europe, South Africa and Pakistan. While Arcelik also noted the lagged impact of higher steel, plastic and large panel prices on profit margins, the EBITDA margin recovered from 7.5% to 9.9% QoQ (though remained short of the 10.5% posted in 1Q17).

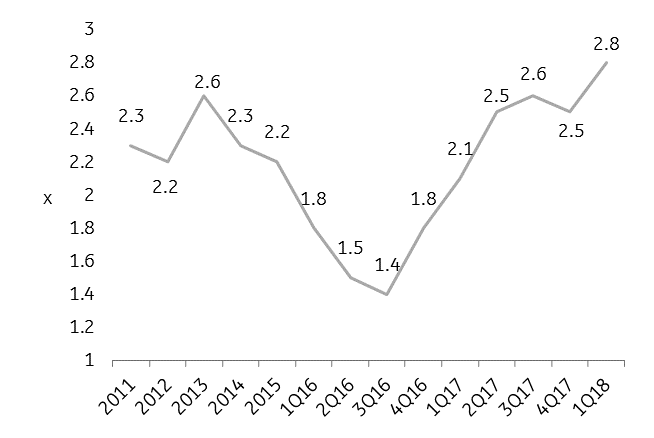

- Turning to the balance sheet, dealer de-stocking caused ACKAF’s working capital to rise 8% QoQ to TRY6.8bn, meaning that the working capital/sales ratio increased to 31.6% (from 30.3% in Q4), slightly above the company’s 30% target. Higher working capital and the currency move also caused Net Debt/EBITDA to increase to 2.83x, up 30bp QoQ. Arcelik expects 2018 revenue growth of c.20% in TRY terms, with EBITDA margins of c.10%.

- Market shares should remain stable or improve in key regions, while the white goods market should see flat to slightly negative (-5%) sales volumes in Turkey and growth of c.2% abroad. The Turkish volume growth number was revised down.

Earnings in detail

-

Arcelik reported a robust sales performances abroad but struggled at home. Overall 1Q18 revenues in Turkey fell 3% YoY to TRY1.9bn, while headline international revenues increased 26% to TRY3.4bn, although the latter grew just 10.6% on an organic basis and was inflated by TRY depreciation. Turkish sales volumes fell 25% YoY in Q1, worse than the market’s 19% decline, as activity fell following the expiry of last year’s sales tax break. 1Q17 was also a particularly strong quarter due to the tax incentive. The International segment saw sluggish growth in Western Europe and much stronger performance from Eastern Europe and South Africa. Asian operations are also performing well, with Dawlance growing 20% in Pakistan and refrigerator production ramping up in Thailand (+30% YoY).

-

Rising metals and plastics costs (+15% and +8% YoY respectively) remained within budget and margins improved following domestic price hikes, strong EUR against the USD and a 50bp YoY improvement in the Opex/Sales ratio thanks to operational leverage and strict opex control. Overall, the 1Q18 gross margin rose 0.5ppt YoY to 31.2%, while the EBITDA margin improved 2.4ppt YoY to 9.9%.

-

However, the decline in activity hit the balance sheet. Dealer de-stocking inflated Arcelik’s inventory, causing its working capital needs to rise 8% QoQ to TRY68bn. This pushed the Working Capital/Sales ratio to 31.6%, up 1.3ppt QoQ though still close to the company’s 30% target. High working capital requirements have historically been one of Arcelik’s main challenges so, while we are comfortable with the ratio at this level, we would not want to see it deteriorate much further as the company would imperil the credibility it has worked hard for since 2016.

Arcelik's sales by region

- Balance-sheet metrics also deteriorated somewhat in Q1 from a strong position. Cash was flat QoQ as the TRY435m dividend payment offset the return to positive operational cashflow, while net leverage worsened from 2.5x to 2.8x QoQ, due largely to higher working capital needs and, to some degree, the weaker TRY.

While we are comfortable with this cyclical upswing in leverage as long as the company demonstrates that it is willing and able to maintain its prudence over the medium term, the surge in leverage was greater than we were expecting. We would certainly not want to see it break above 3x for any sustained period. On the flip side, we take comfort from the flexibility afforded Arcelik by its strong operational performance and robust parental support structure.

Arcelik's Net Debt/EBITDA

-

Net operational cash flow improved to negative TRY14m in 1Q18 from negative TRY410m at year-end, due to a smaller rise in trade receivables and much higher payables. This allowed Arcelik to ease bank borrowings from TRY934m to TRY667m over the period and meant that it ended 1Q18 with TRY2.6bn of cash, flat QoQ despite higher capex (TRY233m) and dividend payments (TRY435m).

-

Arcelik has revised down its Turkish white goods market volume growth guidance to a range of -5% to flat. Other guidance is unchanged. Arcelik expects stable to higher market shares in key regions, revenue growth of 20% in TRY, an EBITDA margin of c.10% and a long-term EBITDA margin of c.11%.

"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).