Aluminium…and breathe

ING attended the CRU World Aluminium conference and learned that Rusal metal will resume flow into Europe, as OFAC granted extensions for existing contracts. After some of the most volatile trading sessions in history, the market has been given some breathing room, but a crunch still looms

OFAC notice brings calm, for now

The market impact and interconnected complications following US sanctions on Rusal, the largest producer of aluminium ex-China (c.13%), appears to have even surpassed the expectations of the US Treasury, when on Monday 23rd April they gave a crucial market moving update to sanctions originally imposed on 6th April. The key points are:

- “The path for the United States to provide sanctions relief is through divestment and relinquishment of control of RUSAL by Oleg Deripaska”(OFAC FAQ 576). Prices immediately sold off 8% as traders weighed the possibility that Rusal material could return to the market unsanctioned. Prior to this, the market had no clarity on whether such a move would be sufficient for the Treasury. There are numerous political and game theories at play here and being metal analysts, not experts on Russian-US politics, our base case for the aluminium outlook assumes that the current sanctions remain in place.

-

“Allow..to continue maintenance and wind down activities until October 23rd" (OFAC FAQ 575). This change is significant since it allows both US and non-US entities to continue with any pre-existing offtake agreement with Rusal until 23rd October without being in breach of sanctions. The initial sanction notice only gave leeway until 5th June, which was too tight a timeframe, leading to the market hysteria evident by huge backwardations on the LME and surging premiums. The key word here is maintenance, however. The sales contract must be prior to the 6th April sanctions, so any fresh spot sales or new contracts risk being in breach. To put it another way, any contract that gets closed out/force majeure will require Rusal to find a new customer willing to risk secondary sanctions. We also understand the measure allows banks to more easily release those Rusal stocks in transit held up in trade financing.

-

A key change from the original temporary license ending 5th June is that payments from both US and non-US entities to Rusal can now be made into non-blocked accounts (until 23rd Oct). Now that Rusal can directly receive and generate sales, this gives the company considerably more incentive to make good on those existing sales agreements. It also provides the company with the liquidity to support its existing operations.

-

‘’All accounts….remain blocked…except for use in maintenance and wind down activities’’. In the interests of directing payment to non–blocked accounts, its likely sales arrangements will look to switch to Euro to divert the US clearing system.

-

Rules surrounding LME deliverability are unchanged, only Rusal metal produced pre-6th April are deliverable to the LME.

Let the metal flow

Our conversations with traders and consumers confirm that, following the OFAC, many traders with existing Rusal contracts will indeed continue to run those contracts through to the new 23rd Oct deadline. Bloomberg News has reported that Glencore, the largest offtake partner could also be close to resuming Rusal sales. We are forecasting therefore that from Turkey, Russia and other European markets, over 50% of Rusal sales could find a home until the October deadline. We remain somewhat less certain about Japanese and US markets, with no news yet on fresh sales being made into China but with Shanghai deliverability alone, it remains an option if the trade finance can be secured. For traders taking those contracts, there is still the hanging risk that multinational consumers could shun Rusal metal period, but the tightness in the market, especially for value-added products (billet/slab etc), will make that a tough stance for any procurement team to hold.

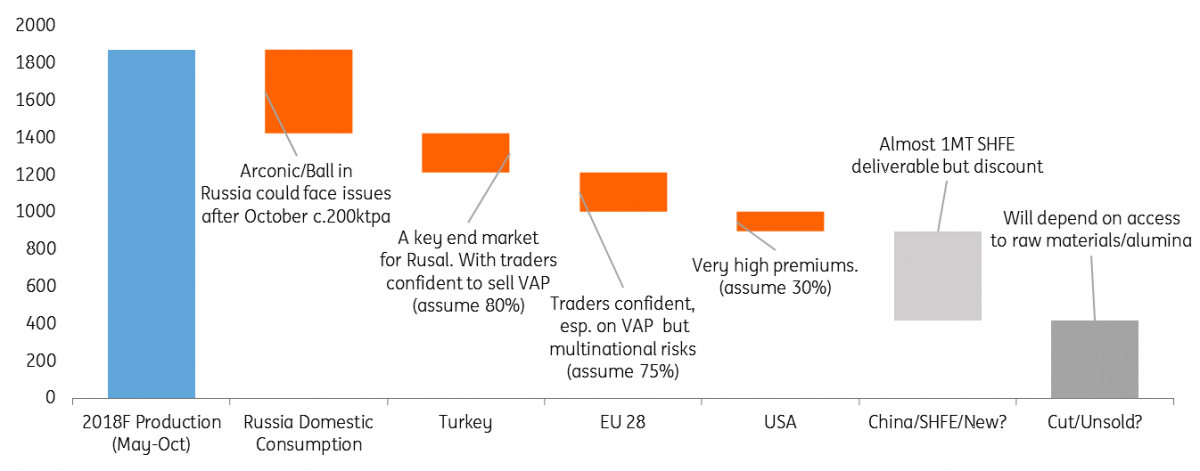

Where might Rusal metal go before 23rd Oct? (kt)

Visulisation/indicative only, estimates based on May- Oct, 2017 sales and interviews with traders.

The key takeaways from Industry

In addition, we highlight the key points below from our meetings with industry, conference presentations and our own recent analysis:

1. Rusal is intertwined across the aluminium supply chain

Rusal is the world’s largest aluminium producer out of China and sells metal into Europe, the US and Japan. It typically sells via traders e.g. Glencore which is well placed to provide credit terms to customers. The vast majority of its smelters are in Russia (+ Kubal in Sweden) but over 60% of its alumina production takes place outside of Russia. The QAL refinery in Australia is a joint venture with Rio Tinto whilst its 1.9MTpa Aughinish refinery in Ireland consumes bauxite from Rio (which has since declared force majeure) and, in turn, mostly supplies non-Rusal refineries, including Rio’s operations in Europe. Rusal’s Russian alumina refineries are more reliant on Russian-based bauxite and along with those in Guinea, continue to operate while both bauxite and alumina assets across Australia, Ireland, Jamaica and Guyana have seen shipments halted. Rusal, on a net basis, is actually only a minor net seller of alumina c. 207kt in 2017 (ex-switches) but this is only after considerable purchases and sales (1.8 and 2.02MT). Needless to say, these intertwined relationships have been thrown into chaos following the sanctions.

2. It’s about more than just ingot

Rusal's 3.7MT of aluminium metal production, whilst significant (c.13% of ex-China production), still understates the real reliance by the aluminium supply chain. Last year, value-added products were 47% of Rusal sales and CRU estimates 9% billets (precursor for extrusions), 17% slabs (rolled into sheets e.g. auto-sheet). These value-add markets are considerably tighter than for primary metal ingot. Billet surcharges already surging over 15c/lb in the US (paid on top of the Midwest premium) and reportedly around $400/t in Germany. It's these value-added consumers who will be squeezed most by any loss of Rusal supply, making a compelling case for traders/consumers to continue with current Rusal contracts prior to the October deadline.

3. Breathing room only, but sanctions and higher prices are coming

As things stand on 23rd October, 13% of ex-China production can only be purchased by traders/consumers willing to take the risk of secondary US sanctions. Monday's announcement means a good deal of the metal will flow freely until then but that proportion will be expected to decrease significantly thereafter, (at least ex-China). Consumers are naturally looking to secure contingency for after October, and failing a dropping of sanctions we would expect global premiums, product surcharges and LME prices to be rising significantly beyond this date.

We are now forecasting $2,450/mt on the LME for Q4, reflecting the returning need for a wide LME-SHFE arb that can incentivise high Chinese exports of semis and even primary metal. We would be more bullish but we expect alumina prices to retreat and much of the pinch point will be on value-added product vs. LME/ingot.

4. Pre-April 6th material losing its stigma..mostly

211kt of aluminium has been delivered on to the LME since Rusal sanctions were announced 6th April. We believe a good deal of this was Rusal metal although backwardations in general incentivised deliveries. Whilst sizable, given that 25% of off-warrant stocks have been estimated as Rusal metal, we were surprised more did not appear. We think this reflects confidence in the LME’s process for accepting pre-6th April material and the ultimate ability to market the metal to consumers as sanction-free material. It's also been reported to us that those warrants are losing their stigma in Europe at least, although Asian/Japanese markets are still more cautious. We will be watching closely for the degree of warrant churn. Since we estimate Rusal stock is now over 40% of LME stocks, if the warrants are shunned, it could significantly loosen spreads at the very front of the curve, undermining one of our original bull drivers for aluminium: 2018 aluminium outlook. From our conversations this is not the case.

5. Alumina prices are unaffordable on desperate but thin confirmed transactions

Metal Bulletin reports alumina at $700/t, which is up $240 since the end of March, or an extreme $460 of cost for a smelter to produce a tonne of aluminium. As above, Rusal is on a net basis fairly minimal in alumina but it acts as a significant buyer and seller. The Aughinish and QAL refineries are particularly at risk, with the former supplying to smelters across Europe. And all this is on top of the ongoing 50% curtailment at the 6.2MTpa Norsk Hydro Alunorte refinery in Brazil. No doubt if alumina prices stay at these levels, primary smelts would have to cut production and aluminium prices would need to rise, but we see more likelihood that prices will retreat based on the following.

- The OFAC extension allows for Rio to continue its bauxite shipments and continue buying alumina from Aughinish (i.e. as maintenance of existing contracts). Rio has not yet confirmed whether it would continue such an agreement but the risk to its own smelters continuing operations are a clear incentive to do so.

-

Panic prices: The scale of increase between price prints for alumina reflects the lack of liquidity in the spot market and not a fair balance of buyers and sellers. The alumina market is c.130MT in size but the spot transactions on which the market is priced might only be a few million tonnes. We understand it's only been a few cargos (c.30kt each) fixed at these higher levels. As prompt delivery cargos these prices demonstrate some extreme buying of some individual smelters caught net short and not wishing to incur the costs of stalling a smelter.

-

The worst case is unlikely: The Rusal alumina impact is most extreme if the company both curtails alumina production/sales and keeps and even steps up purchases to maintain current aluminium production. This post sanction balance is highly unlikely since Rusal would need to enter into fresh spot contracts to buy alumina, not OFAC licensed to 23rd October. The Chinese might export more but Rusal will be competing with other smelters here as well. If Rusal alumina production drops and they become net short of alumina prices it’s likely the high alumina prices force Rusal to also cut aluminium production. After October, we think there is time for Rusal's would-be buyers and sellers of alumina to operate more independent supply chains.

-

Exports/Spare capacity: The arbitrage between domestic Chinese alumina and Australian prices has reached over $200. It’s expected that at these levels China will stop importing alumina and even turn exporter. Compared to 2.8Mt alumina imports last year, this could be a total net contribution of 380kt per month (+150kt of monthly exports) to the ex-China market. Our talks with consultants also tell us that alumina utilisation is around 85% globally (ex-Rusal/Alunorte). Many smelters in China are running lower so given that higher alumina prices are likely to encourage higher utilisation it is worth noting +10% equals 5MTpa, which is almost equal to the Alunorte outage & Rusal sales.

6. China is facing its own cost inflation

Should the West indeed end up deprived of Rusal metal, it will be increasingly up to China to fill the void. This will be met by a combination of increased semi-processed exports, and perhaps even primary. As the balance pivots to the Chinese smelters to supply more of the world's aluminium, the Chinese cost curve will increasingly be the key price driver. While alumina prices are expected to retreat and domestic prices have a wider discount, somewhat higher raw material prices can be expected compared to 2017. Also in the shadow of the Rusal drama but certainly important was recent news from the NDRC that Chinese captive power based smelters could soon face additional cost hikes by being forced to contribute into government and policy funds. Antaike estimates that if fully enforced, those smelters will see cost increases of $80-$130/t. The impact will be structural and long-lasting as the government will also look to clear up illegal and unqualified captive coal-fired power stations, in turn risking slower capacity growth and capex challenges. Any smelters forced to move to the main grid will generally also operate at higher costs.

7. And don’t forget about 232

It seems a lifetime ago, but the US tariff debate remains in full force. The EU/Argentina/Australia and Canada have been given exemptions on 10% duties that are soon expiring on 1st May. Other producing countries eg. Bahrain are appealing for further exemptions. Any shift of trade policy could refire movements in the midwest premium, which seems to now be coming off the boil, as the CME forward curve has shifted into backwardation.

Whilst consumers generally are accepting that many countries beyond just China/Russia will likely be charged a 10% US duty, the subject of quotas remains a big issue with concerns that exporting nations could be heavily penalised for increasing their flows compared to last year.

On the other hand, the longer-term recovery of US domestic smelting could help balance the future ex-China market. Restarts are confirmed by Hawesville, Magnitude 7 and Warrick. But the additional capacity is still awaiting any development (Mt Holly, Wenatchee etc). The true competitiveness of US smelting was put up for debate: with an average age of 1971 its smelters are older than the rest of world and hold the top of the ex-China cost curve (c. $1,955/t). The trade duties and potentially quotas are, it seems, necessary to prop up a less competitive industry though ultimately, investment and modernisation are required.

8. Volatility has something for everyone

Market volatility can be uncertain and cause panic but it also creates opportunities. Should the violent moves resurface, producers should look to hedge into rallies and consumers into dips. Considering the scale of recent moves, if Oleg Deripaska does indeed relinquish control we can expect markets to be oversold in the near term. When aluminium traded below $2,000 in late March, prior to the sanctions, we had warned prices were, in fact, too low. Consumers should consider our original bullish stance, given ex-China deficits, when deciding to act on hedging future prices. Deep backwardations like the last week's can also provide suitable discount future dates even if panic ensues at the front of the curve.

Finally for the producers, we would highlight the discount for put options vs calls that play well to collar strategies but more generally disagree with holding out for some of the recent forecasts calling $3,000 aluminium. These levels, if ever hit, are unsustainable. Rallies in commodities unlock supply responses and in aluminium, we only need look to high off-warrant stocks, chinese exports and widening scrap discounts as proof of the fundamental headwinds that can quickly curb excessive price movements.

"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).