Aluminium premiums see little impact as tariff exemptions expire

US Aluminium premiums only showed the mildest nudge after tariff exemptions on EU/Mexico and all-important Canada expired yesterday. Like the market, we don’t think they will stay, but the lingering debate on quotas could make a big difference

Making US Aluminium great again?

The section 232 tariffs will have the greatest effect on US Aluminium prices since the country is far more dependent on imports than steel.

In 2017, the US imported 4.8Mt or 87% of its primary metal and even as new US smelting capacity ramps up this year (Hawesville/Warrick confirmed and potentially New Madrid/Mt Holly), the US will be lucky to produce 15% of its domestic needs. Comparatively, the steel industry only relies on 30% of imports, and mills could increase capacity to fill the void.

For aluminium, this isn't possible. Substantially reducing US reliance on aluminium imports would take years and huge investments into smelting capacity. The imposition of tariffs on aluminium therefore naturally flow into higher local prices paid by consumers, aka the US aluminium premium which is the price paid over and above the global LME reference.

Reducing US reliance on aluminium imports would take years and huge investments into smelting capacity

That premium has surged this year on the back of multiple factors. First, there was the run-up to the section 232 duties (from 9c/lb to 19c/lb: Dec 17- March 18), followed by the supply shock of Rusal sanctions (since April 6th: up to 22c/lb), while being supported by a squeeze on domestic trucking capacity raising freight costs. In perspective, the premiums are now as high as when there was a 600-day queue to remove metal from the LME warehouses in Detroit.

Those queues are since gone, but the major net consuming US market has been gripped by the panic of securing metal in a deficit market and is having to pay to incentivise imports to do so, duties and all.

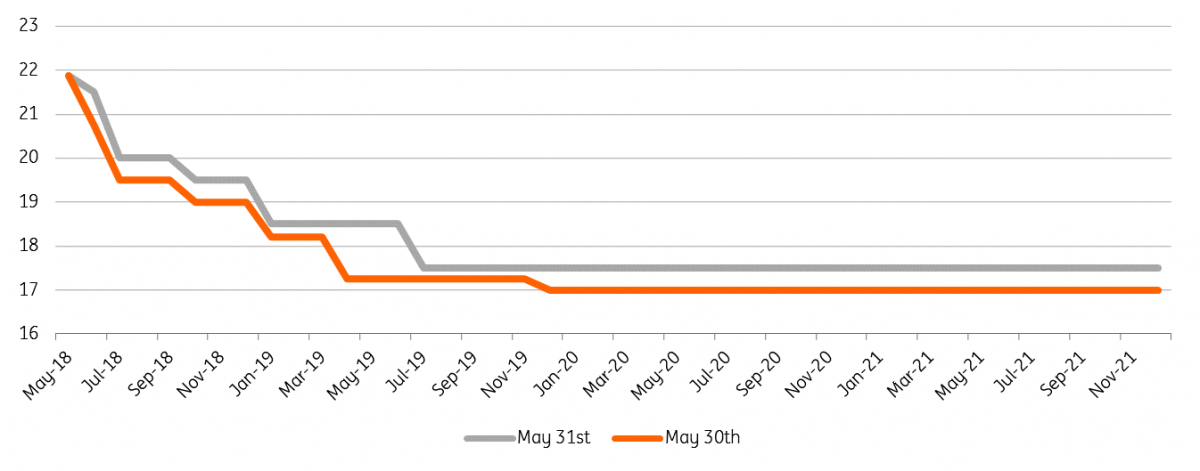

US Premium futures only shows slight move as exemptions expire (c/lb)

Canada is everything when it comes to US aluminium supply. Last year, the country provided over 50% of imports while EU flows to the US were tiny (c.30ktpa). Without an exemption on Canada, there can only be a near 1:1 relationship between the 10% import duty and the premium price paid. US Aluminium consumers will need to pay sufficiently to attract metal imports to the US rather than to non-duty paid locations (e.g. Canadian aluminium is duty exempt in Europe).

At current LME, non-duty premiums and freight that’s currently around 20c/lb although clearly, it fluctuates on how global/non-duty premiums will also move as the Rusal situation evolves. Current spot rates have run higher, but with the CME curve in backwardation the market is expecting premiums to settle lower, as the Rusal induced panic eases (an increasing possibility), and that a good flow of duty exempt material, will undercut duty payable metal and therefore put consumers in a position to negotiate lower rates. We also see pressure from off-warrant stocks sold off that were customs cleared ahead of the 232 duties.

Bottom line

The very mild move in the premium curve after yesterday’s news reflects our understanding that the market does not expect Canadian tariffs to last.

We stress that temporary exemptions have expired pending further negotiations and are not a fresh imposition of duties. We would also stress how vocal the US aluminium industry has been of the importance of Canadian supply. We strongly suspect negotiations will, therefore, see a resolve for Canada.

The risk, however, would be that those final negotiations result in some sort of quota system, capping Canada’s ability to fill a more extensive void if the market needs to find alternatives to sanctioned Rusal metal and un-exempt importers (e.g. UAE, Bahrain= 15% of US imports). The higher the proportion tariff payable material needs to be imported/incentivised the closer the US premium will settle to our current 20c/lb ceiling.

For now, though the market thinks otherwise.

"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).