The Commodities Feed: Brent breaks above $30/bbl

Your daily roundup of commodity news and ING views

Energy

Oil markets continue to move higher, with ICE Brent breaking above US$30/bbl yesterday, and settling just shy of US$31/bbl. The strength in flat price has been accompanied by a strengthening in both WTI and Brent time spreads. There has been a real shift in sentiment over the last week, as we start to see a gradual recovery in demand, with the easing of some country lockdowns. The strength in the oil market even caught President Trump’s attention, with him tweeting yesterday “Oil prices moving up nicely as demand begins again!”. What also helps is that whilst we continue to see US crude oil inventories increasing the size of these builds is falling.

The API reported yesterday that total US crude oil inventories increased by 8.44MMbbls over the last week, whilst stocks at Cushing, the WTI delivery hub, increased by 2.68MMbbls. If we see similar numbers released by the more widely followed EIA report today, these will be the smallest builds since mid-March. In today’s EIA report, the market will also be closely watching gasoline inventories and the product supplied number for signs of a continued recovery in demand.

In other oil news, whilst the Texas Railroad Commission made it clear earlier this week that the idea of production quotas in the state is “dead”, we are still set to see sizeable declines in US output starting this month. A number of US producers have recently announced their intention to shut in production in the coming months, which will provide some comfort to the market that storage constraints will not be as big an issue as originally anticipated - this is also reflected in the tightening of the time spreads.

Metals

This week saw the Peruvian government announce its plans to ease restrictions for its mining sector in May, allowing it to restart some operations. This should ease some concerns over mine supply, as it should see the country’s copper and zinc supply returning to the market. Meanwhile, data from FastMarkets shows that China’s bonded warehouse inventory of copper fell from around 339kt at the end of March to 296kt at the end of April, reflecting improved demand in the local market.

Turning to precious metals, and India’s gold imports came to almost a complete halt in April with initial data suggesting inflows of only 60 kg compared to nearly 13 tonnes in March, due to the Covid-19 lockdown. India recently extended the lockdown until 17 May, which is likely to continue weighing on gold demand this month. However, the lack of physical buying hasn’t deterred gold bulls yet, with financial demand for the yellow metal remaining strong.

Gold refineries in Switzerland, Valcambi SA and Argor-Heraeus SA are planning to boost their production levels up to 85% and 90% of their capacity respectively this week. Another refinery, PAMP, is also planning to increase output levels. Rising output would further ease supply concerns, which saw the spread between gold futures and London spot gold reach record highs in March. The latest data from COMEX show that gold inventories continue to climb, with stocks standing at a record 20.6mOz.

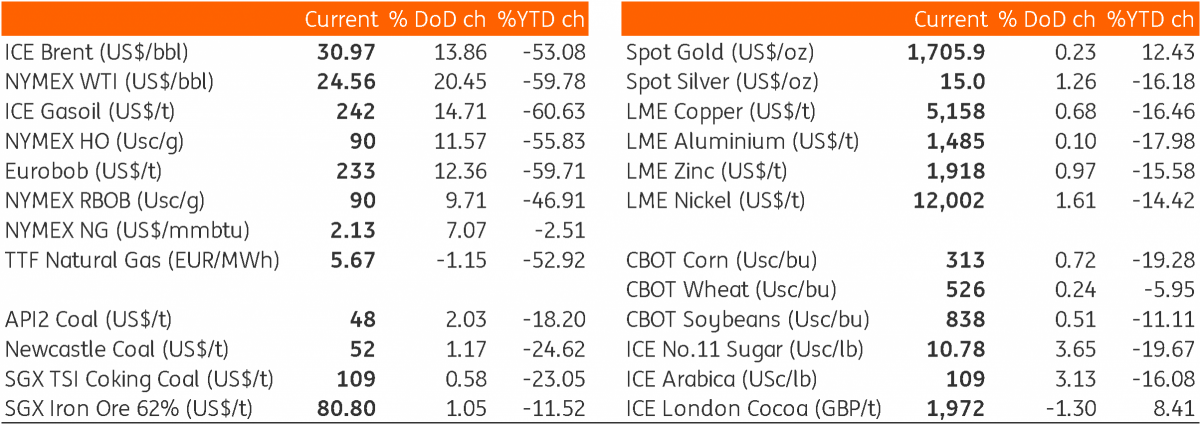

Daily price update