Industry in Poland was very strong before the war

We see evidence of strong external and domestic demand, and while the war in Ukraine may undermine exports to both Eastern and Western partners, domestic consumption should remain sound given spending on hosting refugees at 0.7-1.4 percentage points of GDP

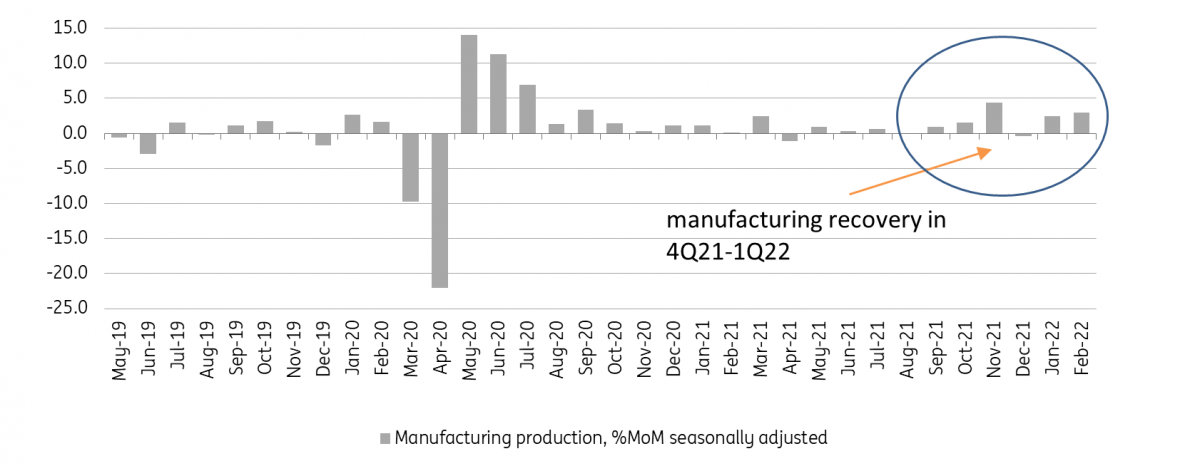

The February data present robust growth of industrial output by 17.6% year-on-year (vs the ING forecast at 18.0% YoY and consensus at 15.2% YoY). Poland’s economy was running hot before the war. The softening of disruptions in global supply chains allowed European industry to bounce back, from which Polish exporters and producers benefited. Domestic demand also remained buoyant despite elevated inflation.

Recovery of manufacturing production in 4Q21-1Q22 before the war; the value chains disruptions were lower in Europe than the rest of the world

We see a rapid expansion in various sectors of industry, ie, Polish export stars but also in energy-intensive industries (chemistry, manufacturing of metal products). The latter may be driven by the recent shift in relative prices that made producing energy from coal cheaper than from natural gas used in Western Europe. Energy from coal, however, remains more expensive than from renewables.

The strong economic performance prior to the conflict should hold average GDP growth in 2022 at a strong level. However, the war should affect exports, to both Eastern and Western partners. The impact will be particularly evident in 2Q-3Q22. March already revealed a significant rise in supply chain disruptions in a variety of sectors (e.g. car manufacturing). Still, internal demand, particularly consumption, should remain strong.

In 2022, we expect Poland to experience a GDP slowdown, driven by weaker external trade and investments, while consumption spending should remain very buoyant (spending on hosting about 2.5 million refugees should add 0.7-1.4ppt to GDP). This suggests a slower GDP expansion, but accompanied by strong price pressures and further interest rate hikes. We also expect another strong fiscal boost in 2022 and 2023, which should strengthen the second-round effects, ie, passing high costs on to retail prices.

Price pressures in industry were high even prior to the war

The price pressures in industry remain high – PPI was 15.9% YoY in February, vs 16.1% YoY in January (after a revision from 14.8% YoY). In month-on-month terms PPI rose by 0.9%, primarily in manufacturing (1.3%). On a monthly basis prices in the manufacture of coke and refined petroleum products increased the most. Prices in the manufacture of other non-metallic mineral products and manufacture of food products rose MoM as well.

The data confirms strong price pressures even prior to the outbreak of the war in Ukraine. Categories experiencing strongest price growth in February are also the areas where we expect to see further pressures from the fallout of the conflict. Companies will continue to pass the rising costs on to consumers, considering strong internal demand, particularly after the arrival of Ukrainian refugees. Therefore we expect double-digit CPI dynamics this year, despite the introduction of the anti-inflation shields.