Gasoline price plunge relieves some of the pressures on US households

University of Michigan consumer sentiment bounced more than expected in August with falling gasoline prices, rising equity markets and a robust labour market relieving some of the pressure on household finances and easing anxieties about imminent recession. With people movement on the rise again it points to a respectable 3% GDP print in 3Q

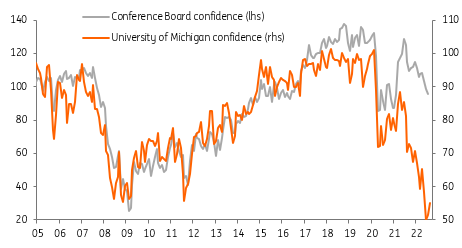

Confidence finally turns higher

University of Michigan consumer sentiment has improved to 55.1 in August from 51.5 in July (consensus 52.5) with the expectations component bouncing from 47.3 to 54.9 while the current conditions weakened to 55.5 from 58.1. The expectations series is the one to watch as this tends to have a better relationship with future spending and likely reflects the hefty fall in gasoline prices.

Gasoline prices have dropped for 59 straight days (from $5.02/gallon on June 13 to $3.98 today) according to Bloomberg data on national averages and it means Americans are spending $400mn less per day filling up their gas tanks. It is also likely that the 15% bounce in the S&P500 since June 16 and the ongoing decent labour numbers are also providing a bit more support for sentiment.

Consumer confidence readings

With more cash in their pockets this is relieving some of the strain on household finances and is already translating into more people movement around retail and recreation based on Google mobility data. This in turn points to a decent uptick in consumer spending in the current quarter and with trade set to contribute positively and inventories set to be much less of a drag versus 2Q, a 3% annualised GDP print is looking possible for 3Q.

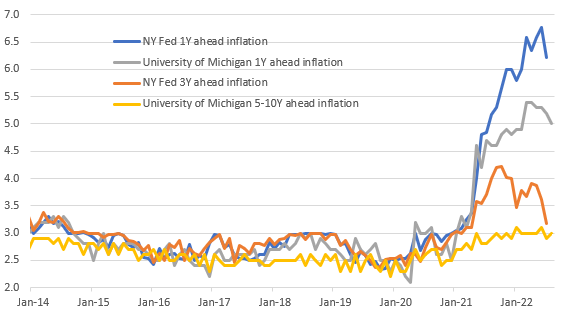

Inflation expectations

Long term inflation expectations hold steady

The one negative was that longer-term University of Michigan inflation expectations didn't fall. 1Y ahead came in at 5% from 5.2% (consensus 5.2%), but 5-10Y ahead inflation expectations ticked up to 3% from 2.9% (consensus 2.8%). We thought we might have seen a decline given the gasoline price developments so underscores the fact that households continue to see broad based price pressures. It probably won't have much impact, but it just re-affirms the Federal Reserve still has work to do to re-anchor those expectations back at the 2% target.

Download

Download snap