World trade to see big shifts and weaker growth in 2023

World trade has been falling, but we still expect growth to return this year. We do notice large shifts in world trade as advanced economies – especially the US – are diversifying input sourcing. With extreme pandemic effects fading, supply chain problems are unlikely to return at the scale seen in recent years

World trade has been contracting

Since the end of last year, world trade has shown clear signs of weakness amid softening demand. Since September, world trade has fallen by more than 5%. When looking at where demand has weakened most, it is interesting to see that the drop in imports was pretty evenly split between the large economic blocs. It is therefore not a story of falling European gas imports, but more a reflection of weaker economic activity related to goods.

Trade has been correcting in recent months in both advanced and emerging markets

China and other emerging Asian countries have seen the largest declines in export growth as global demand has weakened. When looking at how world trade has developed since the start of the pandemic, we saw a very fast recovery after the first lockdowns which was mainly due to fast export growth from Asia and import growth from the US and eurozone. When economies reopened more fully, we saw a moderation in trade growth which has now morphed into outright losses.

The pandemic shock to global consumption has likely played a large role in trade trends in recent years. The initial phase of the pandemic resulted in lopsided consumption towards goods, which has now reversed towards services demand.

Supply chain problems are easing rapidly

The main problems around world trade in 2021 and 2022 were related to supply chains. Transport costs soared on the back of container shortages, lockdowns caused production stops and inputs were in short supply. This resulted in soaring costs, high supply delivery times and depleted inventories. Since the middle of last year, more or less coinciding with the peak in world trade, we've started to see a turnaround in supply chain problems. They have eased substantially since then as global demand for goods has weakened and production capacity has been improving. Arrival availability of container vessels has also improved to 60% in February 2023 compared to 30% at the start of 2022 which helps to improve the global supply system.

Supply chain issues have faded quickly in recent months

Lower commodity prices suggest supply and demand are balanced better

From the perspective of input shortages, it has become clear that high prices over recent years have consistently come down for key commodities. Looking at the main commodities followed by the World Bank, we see that many have fallen dramatically since their peak. Over the last three months for which data is available, which is through February, most large commodities have seen declining prices. At the same time, we still see elevated price levels for many. This suggests that we’re currently in a period of normalisation for input prices, though distortions are continuing to impact some.

Commodity prices are normalising but most are still well above pre-crisis levels

Don’t expect supply chain problems of recent past to return

The broad-based supply chain problems of recent years share a root in the pandemic. Thanks to sizable government and monetary intervention, incomes in advanced markets stabilised or even jumped despite a huge drop in GDP. In terms of consumption, services were very restricted, which resulted in outsized demand for goods. This resulted in overheating global demand for goods while supply was still very restricted because of pandemic-related limitations, and because businesses had scaled back production capacity. This rare mismatch of supply and demand resulted in extraordinary imbalances and broad-based shortages.

Since then, demand has been normalising as services are more widely available again. For many inputs, quickly created new production capacity is coming online and resulting in higher production. This has resulted in rapidly improving supply chain problems. The lesson for the future is that the unique nature of the shock allowed for such widespread problems to occur. While we expect that shortages will continue to feature on the economic agenda as labour shortages remain more persistent and the energy transition could lead to new supply squeezes, we do deem it unlikely that similar broad-based shortages will return without a shock the size of the pandemic.

Container spot rates on major trade lanes dropped steeply from highly elevated levels

Weekly port to port containerised freight tariffs in $ per FEU (40 ft container)*

Container rates have bottomed, supporting trade

The exceptional mismatch in supply chains has clearly been reflected in container rates. After sliding from peak levels for a year, container spot rates stabilised just above pre-pandemic levels in the first quarter of this year. Early April spot rates are some 75% lower than the average of 2022 on the China-US West Coast trade route, and on the China-Europe trade route, the decline is over 80%. This means point-to-point transport costs of newly arranged 40ft container slots are $4,000-9,000 lower than last year’s average. This is significant and could support trade in lower-valued or voluminous consumer products. At the start of 2023, over 50% of global container volume was fixed in term contracts, with locked-in higher rates, but most of these expire over the course of the year, after which lower rates for shippers will materialise.

In contrast to container costs (consumer goods), transport costs for oil and oil products have surged due to disrupted energy markets. But given that the transport costs of oil products relative to their value is limited, there are more important drivers for oil trade than these costs, which tend to have a bigger impact on lower-valued consumer products.

High inventories and reduced goods spending corrected trade volume

With the continuous supply chain disruptions in mind, shippers started ordering and replenishing inventories earlier in 2022, betting on continued strong consumer demand. However, over the course of the year, consumers reduced spending on goods amid spiking inflation and their priorities shifted back to services. This put pressure on shippers to moderate mounting stock levels, especially in downstream retail activities. While the ‘bullwhip effect’ of stockpiling across the supply chain added to trade volumes earlier, the process of stock reduction has since created extra slack in the figures. Although this process has not yet finished, we expect trade to recover mildly over the course of this year on the back of the reopening of China, starting at the end of the first quarter.

All in all, we expect total trade to grow at just 1% compared to last year, with 2024 offering a 2% gain in trade volume. This means trade should drop below global GDP growth and will continue to progress slowly compared to long-term averages.

World merchant trade growth to lag GDP development in 2023-2024

(Development volume in %YoY)

The correction is not necessarily the start of deglobalisation though…

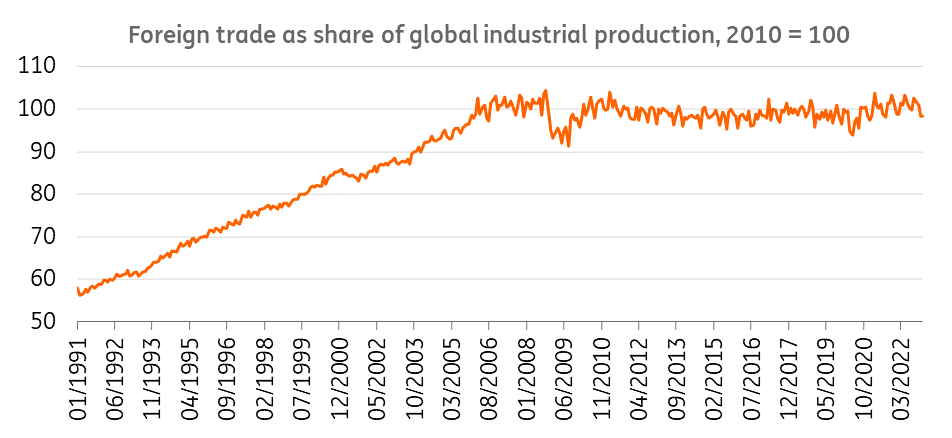

It would be an easy conclusion to say that this drop in world trade marks the first evidence of deglobalisation. But the chart below shows that this is not in fact a logical conclusion to draw from recent developments. Industrial production has also not performed very well recently, which means that our measure of globalisation (world trade as a share of global production, which gives a timely view on trade openness) has not moved outside of the general band that we have seen since roughly 2006. Before then, we saw a rapid increase in globalisation, but it has since plateaued. So despite supply chain problems, geopolitical risks and production disruptions due to the coronavirus, we have not had a meaningful deviation from the stable trend in globalisation seen in the past 15 years. Of course, it’s important to note that a global trade openness indicator does not capture all the nuances of globalisation. Nearshoring elements are not captured by this indicator for example. So below we take a deeper look at how trade is changing.

Globalisation measures are relatively stable despite falling world trade

We do see that trade patterns are shifting though. Think of Russia as the most extreme example. The sanctions on Russian exports have led to a restructuring and rebalancing of global oil, and other commodity flows as well as more traded LNG across the globe. European oil imports from Russia have been replaced by imports from places such as the Middle East, while Russia exported more to India and China. And more European coal is now supplied by e.g. Columbia, South Africa and Australia.

Diversification of trade is well underway

But more broadly, it looks like diversification of sourcing products is the most dominant response to supply chain problems seen in recent years. That is not just the case anecdotally and indicated in surveys, we also find this when looking at import country concentration. To gauge whether trade has been diversifying in terms of countries, we use a Herfindahl–Hirschman index to determine concentration. Using the IMF DOTS dataset on trade, we can go back several decades to find how concentrated or diversified imports have been for advanced markets.

Concentration of import sourcing has been the trend since 2016

Over recent years, in fact already since 2016, we have seen steady declines in our import concentration index for advanced economies. This indicates that we indeed see some form of diversification happening in terms of imports from different countries. The pandemic caused some shocks – as it did almost everywhere – related to which countries were open and which weren’t, but in the end, it looks like the previous trend has picked up again as the world is slowly normalising.

Interestingly, we do see notable differences between Europe and the US. In the EU, we note relatively little diversification so far outside of the pandemic shock. The latest data shows a similar level of the import concentration index as in the period between 2004 and 2019. The US is the main diversification force at the moment. American imports are now a lot more diversified than they were in 2016 and this is mainly driven by a clear trend towards a lower dependence on China for imports. For EU countries, dependence on China was already lower and has so far only seen some declines in 2022. This could also just be a lockdown effect as the share of China in EU imports has not fallen below 2019 levels so far. In fact, the EU is still fairly close to its peak in terms of China dependence for imports going all the way back to 1960.

Developments in imports from China very different between EU and US

When looking at the ‘winners’ over recent years, or the countries that gained the most share as exporters to advanced economies, a few trends stand out. First of all, since this is measured nominally, energy – and other commodity - exporters are among the obvious winners given the recent energy crisis. The question is how sustainable this is once prices normalise. Other than that, we also see Taiwan, India, South Korea and Vietnam standing out as countries increasing their export shares to advanced economies. But the same holds true for Mexico, Poland and Spain, so maybe underlying developments do allude to some near- or reshoring after all.

The drop in import concentration in the US is largely driven by China

China stands out as the country that saw its share of total exports to advanced markets decrease the most, although this will have been overstated by Covid-related turmoil. Still, geopolitics does seem to play a role here as this is a broader trend starting around the time of the trade war. We also see weaker FDI coming into China, which is a harbinger for future trade activity. Also, Germany lost global market share, likely also affected by supply-chain problems affecting production. Overall, the movements in advanced economy export shares are relatively small, indicating that the structural shifts in global trade are gradual movements.

China by far the largest supplier of green technology essentials

The share of China in global green technology supply chains per segment, 2021

Protectionism and supply chain lessons weigh on sourcing from China, but self-sufficiency is easier said than done

Although US imports started to diversify before 2020, with less coming from China and more from other Asian countries, this trend has been accelerated by the lessons learned from the pandemic. However, the role of China in global trade remains enormous and is in some cases near-impossible to change in the short- to medium-term. This is particularly true for green technologies which are rapidly increasing in importance in the energy transition – the world is highly dependent on China. The US and Europe are rushing to create their own supply chains for batteries. But China still accounts for 75% of the supplies and for the refinery of battery materials, China is also a crucial link. Nevertheless, in general, the downward trend in China's market share to the US is quite clear and the path of diversification has started slowly but surely. Large container liners like CMA CGM recognise a trend of diversification, but also emphasise this is a long-term process and underdeveloped (port) infrastructure plays a role in this regard.

Supply chain reconfiguration of companies with lessons learned from recent supply chain disruptions is an important recent trend. Companies explain in surveys that reorientation and diversification of sourcing are part of their process to build resilience. This could involve shifting (part of their) production to another country.

It’s too early to call the start of deglobalisation, but far from business as usual

Overall, world merchant trade is still digesting the effects of two major shocks seen in recent years. The pandemic extremes caused a lot of problems related to supply being curbed and demand overheating, these issues seem to be easing rapidly at the moment and we don’t expect supply-chain issues on the same scale as that seen in recent years anytime soon.

At the same time, geopolitical problems are heating up and are starting to have more of a structural impact on world trade. While deglobalisation is a hot topic right now, we don’t see much evidence for it actually happening. We do see that advanced economies are diversifying trade partners, mainly in the US, while in Europe, this trend is likely to take more time. But we still see this happening as higher trade barriers and continued geopolitical concerns are likely in the years ahead.

For the coming years, this means that we can expect just modest growth in world trade, hampered by geopolitical factors, but experiencing some improvement from the fading of pandemic effects.

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more