China: We’re cutting our GDP forecast as deleveraging bites

China's credit tightening is hitting economic activity and we are cutting our 2Q GDP forecast as a result. But don't panic. We don't think this weakness will last very long and we're not expecting a credit crunch

Revising GDP growth downward to 6.7% YoY from 6.8% in 2Q18

We are revising our China GDP growth forecast to 6.7% YoY from 6.8% YoY in 2Q18 but maintain our forecasts for 3Q18 and 4Q18 at 6.7% YoY. The revised GDP forecast for 2018 is 6.70% from 6.75%.

Weaker economic activity could be a result of credit tightening

Economic activity was slower than expected in May.

- Industrial production fell to 6.8% year on year in May from 7.0% YoY in April

- Retail sales grew 8.5% YoY from 9.4% in April

- Fixed asset investments have fallen to 6.1% YoY year to date from 7.0%

We have found that credit tightening has had a big impact on economic growth.

Slower retail sales growth as consumers wait for tariff cut to be reflected in prices

Slower growth in retail sales has been broad-based, with the exception of telecommunication items and petroleum and related products. Even automobile sales posted a negative 1% YoY growth rate. The slower growth has been caused by:

- A high base, as retail sales growth has been strong for many years.

- Tariff cuts, which have encouraged consumers to wait for prices of imported goods to come down. This applies to automobile sales and daily consumer products. Sellers of goods imported before the tariff cuts may need to lower their prices to attract consumers, so we may see a revival of retail sales in June.

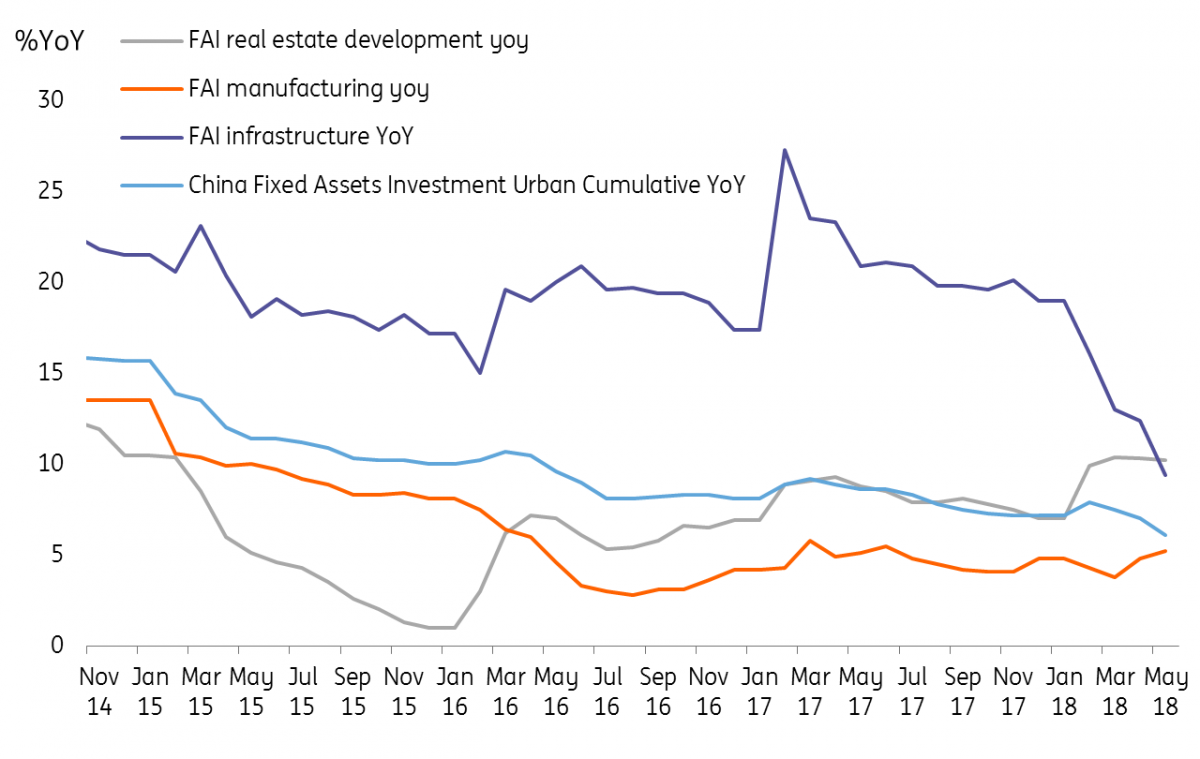

Fixed asset investment shows only in manufacturing

A slowdown in fixed-asset investment growth has also been broad-based but in varying degrees for different industries.

Investment in transportation fell 2.3% YoY YTD, of which investment in rail transport was down 11.4%. This is a direct result of financial deleveraging reform that has tightened issuance of wealth management products, of which the underlying assets are usually local government-supported infrastructure projects.

High-tech investments and manufacturing should be able to pick up. Fiscal and monetary support for high-tech and SMEs will offset the loss of economic growth from credit tightening.

Still, investment in computer telecommunications manufacturing still held up well at 14.6% YoY YTD. This allows us to retain our bullish stance for 2H18, as we expect more fiscal support in this area.

In addition, real estate development didn't slow as quickly as the headline number. Real estate development grew 10.2% YoY YTD, down just slightly from 10.3% YoY YTD. The central government's gradual approach to deflating the property bubble has indirectly cushioned overall investments.

Trade tensions have had some impact on investment, reflected by a fall in spending by Hong Kong-owned and foreign-owned enterprises. These enterprises focus more on export markets and could delay investment decisions as trade tensions escalate around the world.

Industrial production still has high-tech support

Unlike retail sales, slower growth in industrial production was not broad-based.

Most of the high-tech items continued to grow at a solid rate. For example, industrial robots grew at 35.1% YoY in May up from 33.7% in April, and integrated circuits grew 17.2% YoY compared to previous month's 14.6%.

It seems to us that industrial production in areas related to Made in China 2025 is still holding up well. This implies the current credit tightening from financial deleveraging reform has not hit the high-tech sector.

Financial deleveraging reform will continue to pressure the economy

Credit tightening has led to a rising number of defaults in China and has resulted in weaker economic activity. But growth momentum is not going to return simply by the central bank halting a five basis point rate hike. We think there will be more fiscal support to boost investment in high-tech sectors, as well as monetary support for SMEs ( more on PBoC's monetary policy here) and we don't expect the weakness in May to last long.

With financial deleveraging reform continuing throughout 2018, we don't expect there will be a sudden return of high growth in fixed asset investments in sectors related to transport infrastructure, and that is the reason behind our revised 2Q18 GDP forecast.

But we don't see China facing a credit crunch

We are not expecting a credit or liquidity crisis as a result of tighter credit because:

- Credit measures and liquidity are controlled by the central bank. The central government and the central bank can be flexible in crafting policies to avoid the economy weakening continuously.

- The impact of financial deleveraging on wealth management products (and therefore the underlying assets) should be reflected in around three months' time. The new measures were announced at the end of April, so most of the impact should be seen from May to July.

As financial deleveraging reduces the unnecessary financing of projects, it should also reduce the number of projects by local governments. This would keep investment growth in transport infrastructure at a low level.

In the meantime, high-tech investment and manufacturing pick up.

As a result, we are still optimistic on growth in the second half of this year and expect fiscal and monetary support to offset the loss of economic growth from credit tightening.

Download

Download article15 June 2018

In Case You Missed It: Confidence and cracks This bundle contains {bundle_entries}{/bundle_entries} articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).