The Eurozone’s ‘Japanification’

The prospect of some kind of ‘Japanification’ of the eurozone supports our view that interest rates will remain lower for much longer

This week, the European Central Bank will again experience how difficult it is, once out in the open, to put the genie back in the bottle. While deflationary risks in the eurozone have disappeared, still muted inflationary pressures and concern that the economy may be in the middle of a protracted downswing have brought back speculation about new easing measures.

An end to current unconventional monetary policy, i.e. the negative deposit rate and ample liquidity, is not in sight and the ECB is expected to do everything it can to avoid an unwarranted tightening of its monetary stance.

But a low growth, low inflation environment in the eurozone, coupled with still loose monetary policy, bears a striking resemblance to Japan, which raises questions about the central bank’s monetary toolkit and the options at its disposal.

The 'Japanese disease'

Since the 1990s, Japan has been struggling with an extremely high public debt ratio and very low and even negative inflation and growth rates. Only in 2016 did Japan’s nominal GDP return to levels seen in 1997. Last year, Japan’s debt-to-GDP ratio stood at 238%, and since 1994, headline inflation has been negative for almost half of the time. This trend has also emerged in the eurozone in recent years. In Greece, the sovereign debt ratio rose to 183% following the European financial crisis, Spain was in a deflationary environment between 2014 and 2016, and Italy had to contend with predominantly negative growth rates between 2008 and 2013.

When turning to the causes, both the so-called “Japanese disease” and the euro crisis show similarities. In the 1990s, unprofitable loans, bonds and corporate debt, and a relatively deregulated financial market, led to a bubble in the market and subsequent financial crisis. A similar, albeit profound financial crisis hit Europe and the whole world in 2008, suggesting some comparability. These examples and anomalies raise the question of whether a ‘Japanification’ of the eurozone is, in fact, inevitable.

How to measure 'Japanification'?

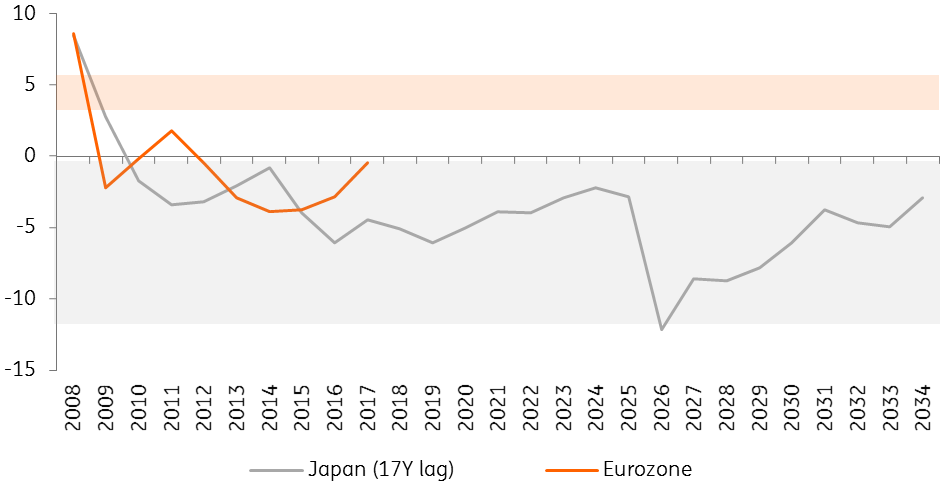

In order to assess this possible ‘Japanification’ of the eurozone, we have created a ‘Japanification model’ based on research by Takatoshi Ito of Columbia University, which is intended to depict the main symptoms of the Japanese disease. The model takes the following into account:

- Economic growth in the form of the output gap

- Inflation

- A short-term interest rate in the form of the central bank's interest rate

- Demographic change

The neutral index value is within a corridor of around four to six, assuming a zero-output gap, a target inflation of two percent, a short-term interest rate of two percent to four percent, and a percentage change in the old-age dependency ratio of zero. The lower the index value, the greater the risk of the “Japanese disease”.

Since 1993, the index value for Japan has been in negative territory, while for the eurozone, it was in positive territory until 2013, apart from a short dip in 2009. However, since 2013, the index value for the eurozone has dropped into negative territory as well, indicating a rapprochement between the two economic zones of late. When we lag the data for Japan by 17 years (assuming that the Japanese crisis started in 1992, while the eurozone crisis started in 2009), the progression of the curves becomes even more similar. Over the last couple of years, the eurozone economy has left its ‘normal’ growth path following the global financial crisis and has dipped into Japanification-territory, which Japan has not left for a quarter of a century.

Japanification model

How 'Japanised' is Europe already?

The succinct answer to this question is probably “to some extent". Even though there are undoubtedly similarities, the eurozone’s current state is still different to that of Japan’s. Japan’s inflation rate has not reached the central bank’s price stability target of 2% since 1993, apart from a sales tax hike in 2014, and has seen 12 deflationary years since 1991. The eurozone’s inflation rate, on the other hand, has avoided deflationary territory on a yearly basis in the aftermath of the crisis. Also, while Japan’s government debt has piled up to almost 240% of GDP, the eurozone’s government debt is down to 86% from 91.8% in 2014. Furthermore, eurozone policymakers have done a lot to avoid another Japanese disease. Just think of bank rescues, government rescues and the ECB’s actions. When it comes to fighting the symptoms at least, eurozone authorities have been much faster than their Japanese counterparts.

At the same time, however, structural similarities remain striking. Just look at demographics. While Japan has the world’s oldest population, the working age population in the eurozone started to shrink in 2009 and these estimates already take into account some continuing immigration over the next few decades, according to Eurostat data. In theory, wage growth in an ageing economy should be muted by rising retirement levels, possibly slowing economic growth. Japan is a good example of this; wage growth has remained subdued despite low levels of unemployment and a shrinking labour force.

The eurozone's 'Japanification' means 'lower for longer'

A ‘Japanification’ of Europe is not all negative, however. Japan is doing very well in many areas, despite the economic developments. According to the OECD Better Life Index, Japan is at the forefront of student achievement, life expectancy and safety at work, outperforming in employment, income and in safety, in general. Inflation and growth should not be the only indicators to gauge the well-being of an economy.

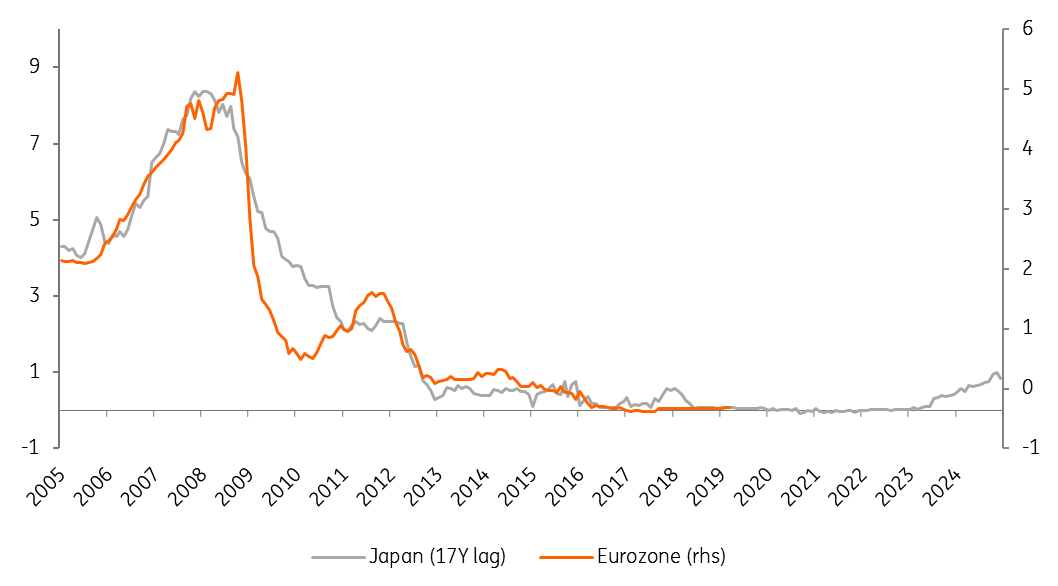

Unfortunately, these more favourable characteristics are unlikely to be sufficient for the ECB’s well-being. The current situation and the prospects of some kind of Japanification support our view that interest rates will remain lower for much longer.

3m deposit interest rate

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more